XRP achieved a fresh all-time peak of $3.41 on January 16. Nevertheless, it has remained within a defined range since that moment, encountering resistance at $3.27 and locating support at $2.94.

Although this horizontal movement signifies a certain equilibrium between buying and selling forces, on-chain metrics indicate that a downward breakout might be imminent in the upcoming weeks.

Increase in Profit-Taking May Jeopardize New Gains

XRP underwent a significant 500% increase in November 2024, propelled by Bitcoin’s surge and Donald Trump’s victory in the 2024 presidential election. Subsequently, the token experienced a slight correction, stabilizing between $2.6 and $2.0 before rebounding.

By January 16, Ripple surpassed the $3 resistance, achieving a novel all-time high of $3.41. Since that time, the altcoin has fluctuated within a price spectrum, implying that neither buyers nor sellers hold complete authority. However, BeInCrypto’s evaluation of XRP’s on-chain activity points toward increasing bearish pressure, which may lead to a price decline in the weeks ahead.

For instance, XRP’s Market Value to Realized Value (MVRV) ratios analyzed across various moving averages imply that the altcoin is overvalued, which might encourage holders to liquidate for profit. According to Santiment, as of this moment, the token’s seven-day and 30-day MVRV ratios are 1.50% and 14.17%, respectively.

The MVRV ratio of an asset determines its overvaluation or undervaluation by assessing the connection between its market value and realized value. A negative ratio indicates that the asset’s market value is beneath its realized value, suggesting that the market is undervaluing the cryptocurrency in comparison to its original purchase price.

Conversely, as seen with XRP, a positive ratio signifies that its market value exceeds the realized value, indicating overvaluation. This metric reveals that XRP’s current price of $3.10 is elevated relative to the acquisition basis for many of its holders, which might lead them to sell their holdings for a profit, exerting downward pressure on the token’s price.

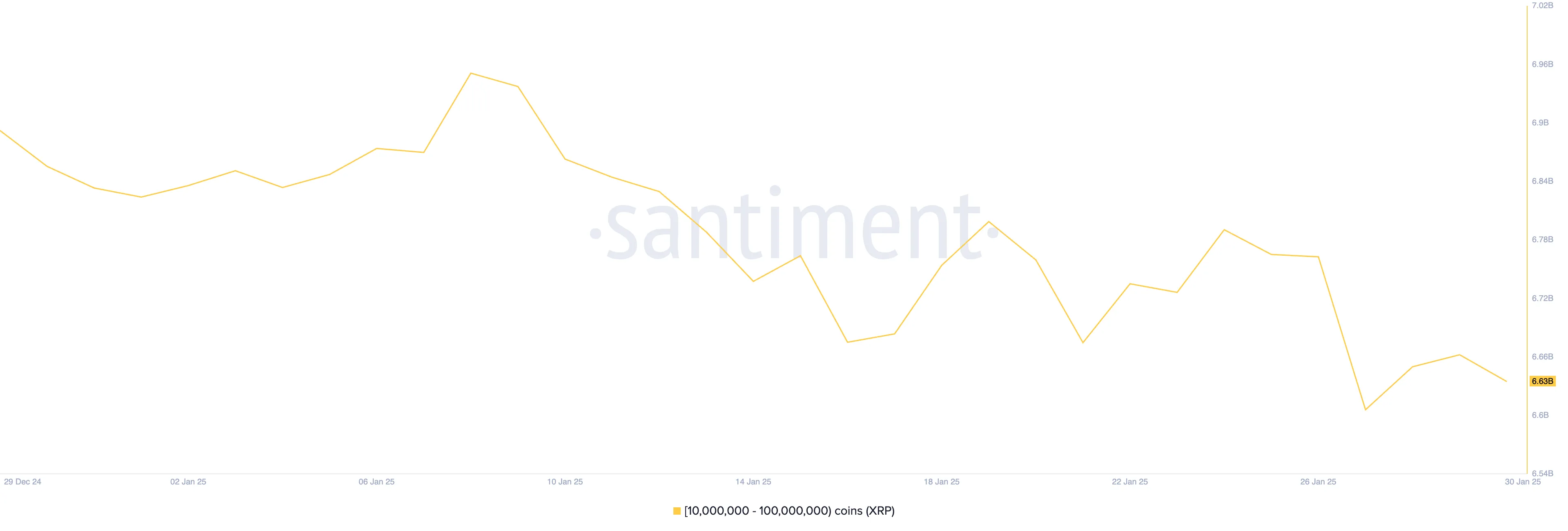

Moreover, the activities of XRP whales might further add to this downward pressure. According to Santiment, addresses holding between 10 million and 100 million XRP tokens have diminished their holdings by 1% since reaching the peak of the market. In the past month, this group of large stakeholders has liquidated 60 million XRP valued at over $180 million.

When substantial holders reduce their positions, it generates downward pressure on the asset’s value, particularly if the market struggles to absorb the selling activity. Should this trend persist, XRP will likely see a decrease in the upcoming weeks.

XRP Price Forecast: Will It Ascend Further or Fall to $2.13?

A decline below the horizontal channel triggered by an increase in profit-taking actions will push XRP’s price away from its historic high. In this scenario, its price could fall below $3 and trend towards $2.13.

However, should the profit-taking activity slow down and holders recommence accumulation, this may drive the token’s price beyond the resistance established at $3.27 towards its historical high of $3.41. If demand is sufficiently robust, it might even breach this price peak to achieve a new record.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis piece is intended solely for informational purposes and should not be construed as financial or investment advice. BeInCrypto is dedicated to providing accurate and impartial reporting; however, market conditions may fluctuate without prior notice. Always perform your own research and seek professional consultation before making any monetary decisions. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

1 Trackback / Pingback