XRP recently reached a new record high (ATH) of $3.40 during a two-week bullish streak, signifying a major achievement in the cryptocurrency’s timeline. Nevertheless, this upward movement seems to have encountered resistance.

All indicators currently imply a phase of correction before XRP can try to replicate such results. The token, presently trading at $3.11, appears to be finding its footing but displays indications of fragility.

XRP May Experience A Decline

One of the primary indicators pointing toward a possible correction is the Price Daily Active Addresses (DAA) Divergence, which is signaling a sell. Despite the optimistic price movements, the quantity of active wallet addresses interacting with XRP has seen a marked decrease. This disparity between price and participation often signals diminishing investor enthusiasm, which could adversely affect XRP’s value.

The declining engagement is alarming as it underscores decreased market interest at a time when XRP would most benefit from robust support. Should this pattern persist, it might jeopardize the token’s capacity to maintain current price levels, rendering it vulnerable to further setbacks.

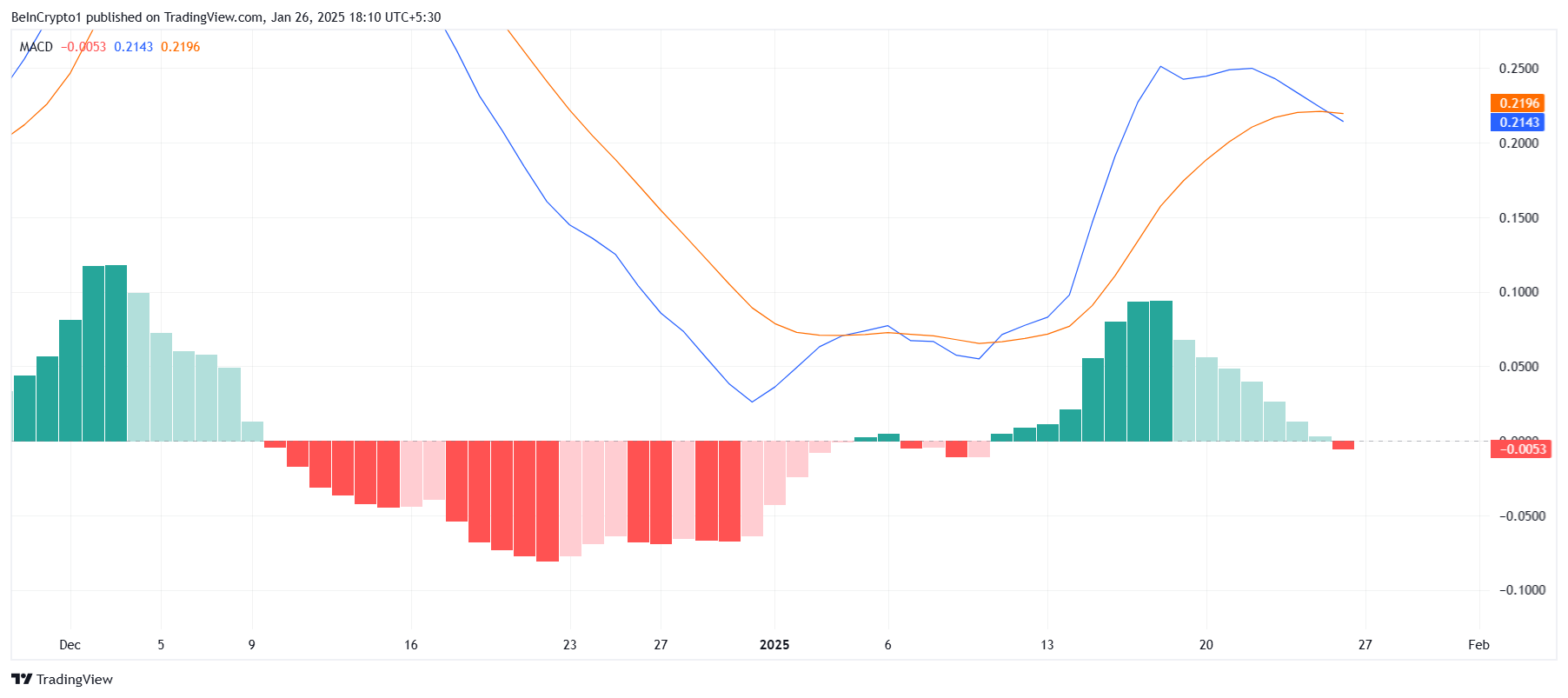

From a technical perspective, the Moving Average Convergence Divergence (MACD) indicator has recently observed a bearish crossover. This change occurred just two weeks following XRP’s upward momentum that resulted in its latest ATH. While the preceding surge was brief, it was influential enough to propel XRP into new price levels.

However, the bearish crossover on the MACD indicates that the general market momentum is starting to weaken. In the absence of renewed purchasing pressure or positive market signals, XRP is likely to confront a price drop.

XRP Price Forecast: Seeking Support

XRP’s recent ATH of $3.40 has not been succeeded by a significant selloff, with the token currently trading at $3.11. At this point, the price appears to be stabilizing. However, the ongoing trends indicate this stabilization might be fleeting.

Considering the sell signals from DAA Divergence and the bearish MACD crossover, XRP may encounter a correction in the short term. The price could decline to $2.73, dropping below the $3.00 threshold before finding support and rebounding. This adjustment would create a more robust base for a potential future rally.

Conversely, a change in broader market dynamics could shift the sentiment towards bullishness. If XRP surpasses its ATH of $3.40, it would invalidate the bearish perspective and open the door for a new ATH. Such a scenario would significantly rely on heightened market engagement and a surge in investor confidence.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article serves informational purposes only and should not be deemed as financial or investment counsel. BeInCrypto is devoted to providing accurate, impartial reporting, yet market conditions can change without prior notice. Always carry out your own research and seek advice from a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been amended.

Be the first to comment