The TON ecosystem has faced challenges over the past week, experiencing considerable declines in user involvement and rising selling pressure. The influx of new users has decreased by an astonishing 95% since the network’s peak in July.

These unfavorable indicators signify a reduction in investor trust and provoke inquiries regarding the ecosystem’s long-term attractiveness.

On-Chain Data Illustrates a Dismal Outlook for TON

As per data from DefiLlama, The Open Network (TON) reached a peak in Total Value Locked (TVL) in mid-July, hitting $773 million.

Since that time, its value has consistently diminished. Currently, the ecosystem’s TVL is at $215 million, indicating a plunge of over 72% from its maximum.

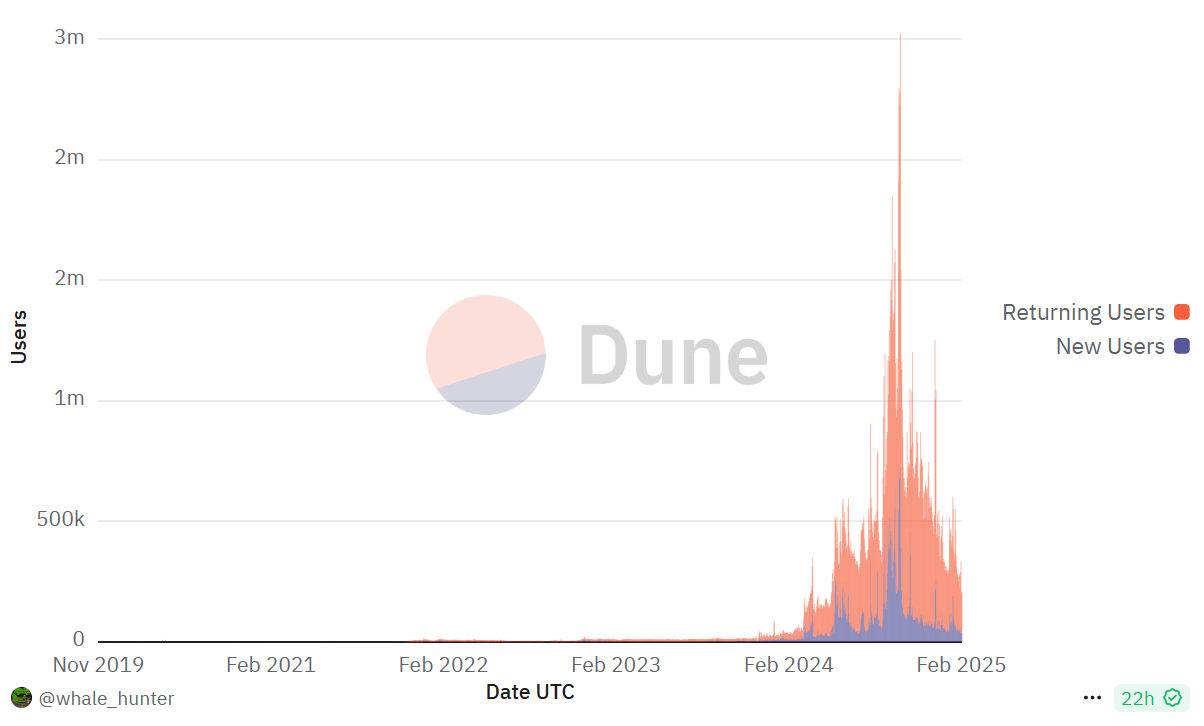

This decline is mirrored by the concerning reduction in new daily users. According to data from Dune, achieved an all-time high of 724,465 on September 30, but by February 5, that count had fallen to merely 33,852.

The more than 95% reduction has prompted worries regarding the blockchain’s current and prospective allure.

Investors involved in TON projects have reported monetary losses, leading to sentiments of frustration on social media platforms.

“Never in my lifetime did I believe I’d witness Notcoin at $0.0033 and Toncoin at $4.2,” one individual commented on X.

Moreover, data suggests that a majority of token holders, around 96%, which equates to more than 108 million addresses, are currently facing investment losses.

In contrast, a mere small percentage, roughly 4% or just over 4.2 million addresses, are registering profits. This information hints at a prevailing negative outlook among TON investors, which could result in heightened token-selling behavior.

The Future Roadmap

TON, a blockchain framework rooted in Telegram, has depended on tap-to-earn and various GameFi applications to promote adoption and stimulate user engagement.

Less than two weeks ago, the TON core team disseminated its developmental roadmap for the initial half of 2025. This blueprint details anticipated updates, including enhancements to core functionalities and the exploration of potential future income avenues.

TON’s expansion strategy is a response to its declining revenues, primarily caused by the reduced popularity and profitability of tap-to-earn games and other GameFi applications that were previously vital revenue generators for the platform.

Although Telegram initially distanced itself from TON in 2020 due to regulatory challenges, the network has recently re-established its partnership with the messaging application under the new regulatory conditions set by Trump.

This action has sparked discussions among users. Some questioned Telegram’s commitment to decentralized ideals, while others voiced worries about potential effects on liquidity and market stability.

The enduring success of newly unveiled roadmap remains uncertain, as the current on-chain data implies possible difficulties ahead.

Disclaimer

In alignment with the Trust Project standards, BeInCrypto is committed to impartial, transparent reporting. This article aims to furnish precise, timely information. However, readers are encouraged to verify the facts independently and seek professional advice before making any decisions based on this content. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have undergone updates.

Be the first to comment