Cryptocurrency markets are set to see almost $4 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today.

Market observers are especially focused on this occurrence due to its potential impact on short-term trends, driven by the volume of contracts and their notional value. Analyzing the put-to-call ratios and maximum pain thresholds can yield insights into trader expectations and possible market trajectories.

Bitcoin and Ethereum Options Expiring Today

The notional value of the Bitcoin options expiring today is $3.19 billion. According to Deribit’s statistics, there are 30,645 Bitcoin options set to expire, featuring a put-to-call ratio of 0.48. This ratio indicates a higher number of purchase options (calls) compared to sales options (puts).

Furthermore, data indicates that the maximum pain threshold for these expiring options is $100,000. In cryptocurrency options trading, the maximum pain point refers to the price at which the majority of contracts become worthless. At this price, the asset results in the most considerable financial losses for holders.

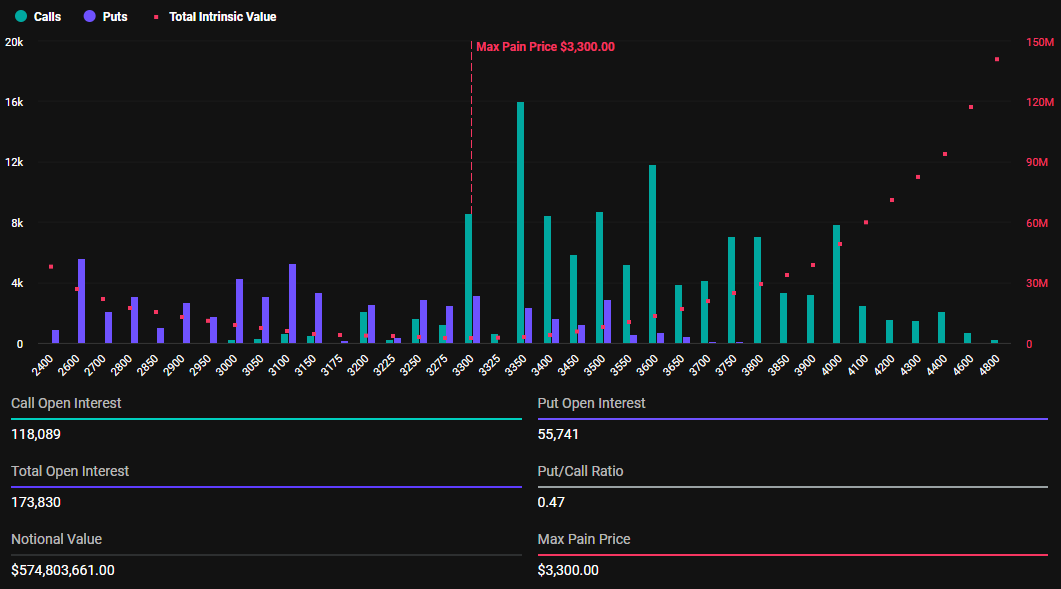

In addition to Bitcoin options, there are 173,830 Ethereum contracts set to expire today. These options have a notional value of $574.8 million and a put-to-call ratio of 0.47. The maximum pain threshold stands at $3,300.

The current market valuations for Bitcoin and Ethereum exceed their respective maximum pain levels. BTC is currently priced at $103,388, while ETH trades at $3,305.

“BTC max pain continues to rise, while ETH traders are positioning themselves near critical levels,” noted Deribit.

This indicates that should the options expire at these rates, it would typically result in losses for option holders.

The results for options traders can differ significantly based on the designated strike prices and their current positions. To accurately determine potential gains or losses at expiration, traders need to evaluate their total options position, along with prevailing market circumstances.

Implications of the Expiring Contracts for the Market

These contracts expiring coincide with President Donald Trump’s executive order to establish a digital asset reserve in the US. If sanctioned, this plan could incorporate a stockpile of various crypto assets beyond just Bitcoin.

Alongside a digital asset reserve, the president has launched a cryptocurrency working group aimed at formulating a federal regulatory framework governing digital assets. The US SEC (Securities and Exchange Commission) has also withdrawn the SAB 121 policy, allowing banks to hold cryptocurrency as custodians.

These developments, in conjunction with the expiration of BTC and ETH options, serve as bullish indicators that may provoke market volatility. Analysts at CryptoQuant provide an intriguing investor perspective that highlights the necessity for thorough analysis before drawing conclusions.

“Is this the tranquility preceding a brewing storm? The market persists in pushing lower even after the SEC revealed the creation of a Crypto Regulatory Task Force. BTC has dipped below $106,000 and is currently precariously positioned around the $102,000 mark,” the analysts commented.

Moreover, analysts note a surge in interest for purchasing options contracts with a strike price of $95,000 for January. This trend may suggest traders are seeking to safeguard against potential downward movements as Bitcoin shows signs of diminishing momentum.

The transition in sentiment from bullish to a more cautious stance is linked to the shifting market dynamics.

Nonetheless, analysts anticipate the cryptocurrency market will remain range-bound until clearer insights emerge regarding how recent economic indicators, particularly the soft Consumer Price Index (CPI) readings, will influence the Federal Open Market Committee (FOMC) meeting slated for next week. This session could significantly affect the Fed’s impending policy decisions.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is dedicated to transparent, impartial reporting. This news article aims to furnish precise, timely information. Nevertheless, readers are encouraged to independently verify facts and consult with a professional prior to making any decisions based on this material. Kindly be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.

Be the first to comment