Michael Saylor revealed today that MicroStrategy allocated $1.1 billion to obtain 10,107 Bitcoin, merely six days after executing a comparable transaction. This action signifies a wider pattern in the company’s acquisition strategy.

The organization utilized the proceeds from a recent sales deal to finance its acquisition. This new procurement elevated MicroStrategy’s cumulative Bitcoin assets to 471,107.

Saylor Advances With Bitcoin Acquisition Trend

MicroStrategy’s founder Michael Saylor persists in making significant Bitcoin acquisitions, which enhances the company’s position as one of the globe’s largest BTC holders. Today, he declared a new investment via social media, marking the firm’s fourth BTC procurement in January 2025.

“MicroStrategy has procured 10,107 BTC for approximately $1.1 billion at an average of around $105,596 per bitcoin and has realized a BTC Yield of 2.90% YTD 2025. As of 1/26/2025, we possess 471,107 $BTC acquired for around $30.4 billion at approximately $64,511 per bitcoin,” Saylor stated.

As per the Form 8-K submitted to the SEC, the Bitcoin acquisitions occurred between January 21 and January 26. During that timeframe, MicroStrategy also disposed of 2,765,157 shares, generating $1.1 billion.

Saylor made consistent Bitcoin purchases throughout December 2024. In the first half of the month, MicroStrategy executed a $2.1 billion acquisition. A week later, another $1.5 billion purchase followed.

On January 6, MicroStrategy acquired $101 million worth of Bitcoin. This transaction represented a notable decrease from preceding multi-billion-dollar acquisitions, prompting speculation that MicroStrategy might pause its acquisition spree.

However, following Bitcoin reaching a new all-time peak of over $108,000 on January 20, Saylor proceeded to boost the scale of MicroStrategy’s acquisitions. As Bitcoin continues its positive performance, the company appears intent on taking advantage of it.

MicroStrategy Stays Committed to its BTC-First Strategy

At the month’s outset, MicroStrategy publicly examined the potential for a substantial stock offering to gather funds for additional Bitcoin purchases. The firm revealed strategies to raise $2 billion through a perpetual preferred stock offering to bolster its financial position.

Funding alternatives for perpetual preferred stock encompass converting class A common stock, issuing cash dividends, or redeeming shares. This framework offers investors the opportunity for consistent dividend payments without a specified maturity date, presenting a distinctive method for capital accumulation.

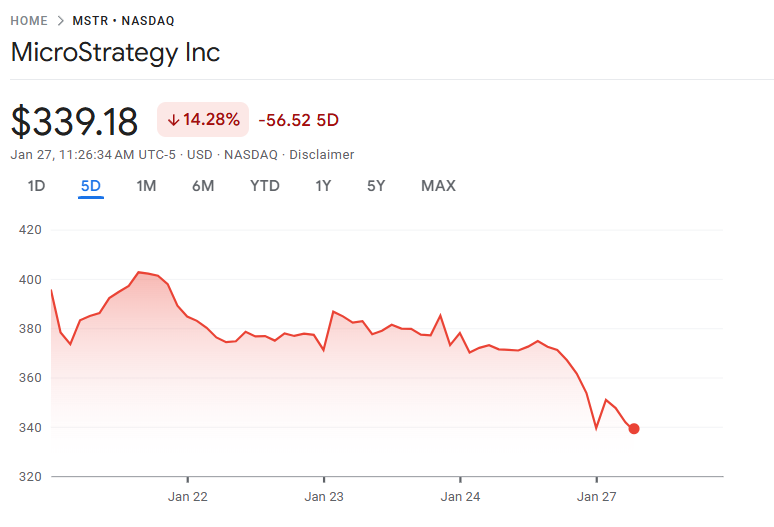

Despite the acquisition today, the organization’s stock was also impacted by a broader sell-off, spurred by concerns surrounding DeepSeek AI. MSTR experienced a decline of nearly 5% today, yet it remains 14% up this month.

Regardless, MicroStrategy is set to persist in expanding its Bitcoin acquisitions throughout forthcoming market cycles. The effectiveness of the firm’s stock offerings will greatly influence the scale of future Bitcoin acquisitions.

Disclaimer

In compliance with the Trust Project standards, BeInCrypto is dedicated to impartial, clear reporting. This news article is intended to deliver precise, timely information. However, readers are encouraged to independently verify details and consult with a professional prior to making decisions based on this content. Kindly note that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.

Be the first to comment