For a considerable time, Bitcoin has served as the benchmark in the cryptocurrency sector, influencing sentiment and market trends. However, recent indicators point to a troubling pattern. Indeed, the leading digital currency seems to be diminishing in attractiveness.

Examining market statistics, search patterns, trading volumes, and investor conduct uncovers a disconcerting trend of waning interest.

Decline in Bitcoin Trading Volumes

One of the initial concerning indicators suggesting decreasing interest in Bitcoin is its trading volumes.

Data from CoinGecko shows that Bitcoin’s spot trading volumes for this quarter amount to $721.10 billion. It’s significant to point out that Bitcoin’s trading volumes for the second quarter of this year hit $1.25 trillion, indicating a potential 14% decrease month-over-month.

Should this trajectory persist through September, the quarterly trading volumes might contract to levels not experienced since the first quarter of 2019.

Similarly, Ethereum follows Bitcoin’s trend, with trading volumes for July and August recorded at $232.06 billion and $212.92 billion, respectively. If this trend persists, Ethereum’s quarterly trading volume may edge just beyond $650 billion, another nadir akin to levels in 2019.

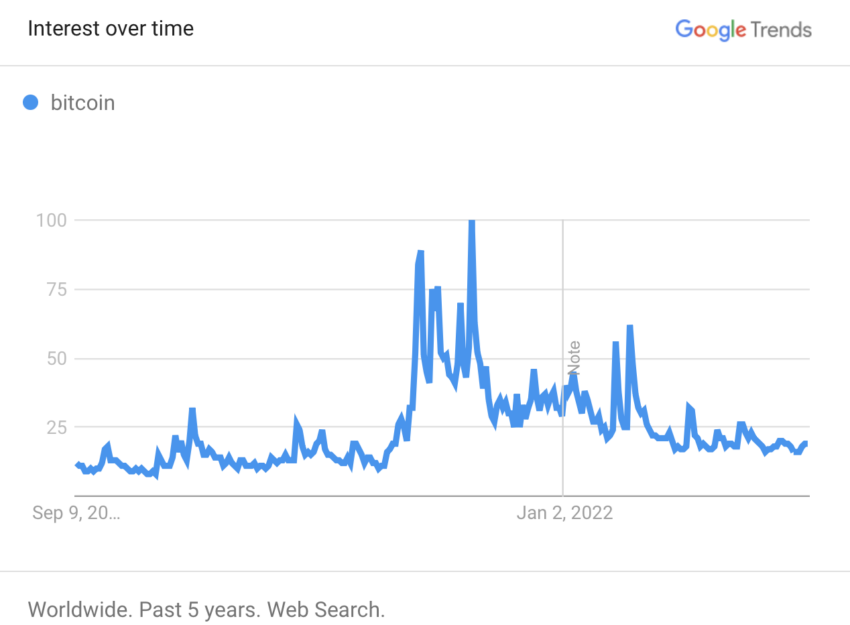

Reduction in Google Search Activity

However, the noticeable downturn in Bitcoin and Ethereum trading volumes is merely the beginning of the issues. Google Trends introduces an additional layer of worry.

Organic search activity for the keywords “cryptocurrency” and “Bitcoin” has reverted to levels last seen in 2019.

“This is precisely what indifference resembles,” stated Will Clemente, co-founder of Reflexity Research.

Although the search activity for Bitcoin has remained relatively stable, the declining trend for the broader term suggests diminished public enthusiasm. This can be regarded as a significant indicator of investor sentiment.

Read more: Crypto Telegram Groups To Join in 2023

The Global Head of News at BeInCrypto, Ali Martinez, vividly drew a comparison between the search interest in leading keywords in the sector, likening it to the term “Uranus” to underscore the diminishing enthusiasm.

As per Martinez, there are more individuals searching for the planet Uranus than for Ripple, even following the recent judicial ruling in the lawsuit against the United States Securities and Exchange Commission (SEC).

Minimal Volatility and Investor Sentiment

Even more concerning, volatility measures, historically recognized for its price fluctuations, remain subdued.

In a current analysis, the crypto exchange Bitfinex revealed that the difference between implied and historical volatility stands at merely 1.3%, suggesting that market anticipations are for ongoing low volatility.

Read more: What Causes Bitcoin Volatility?

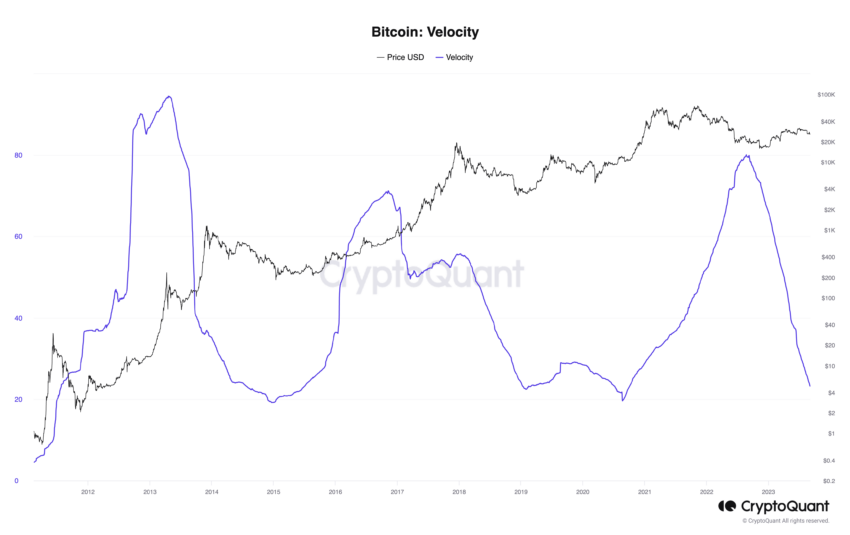

The subdued volatility context is further highlighted by Bitcoin Velocity, a metric that serves as an indicator of market engagement. The decline in Bitcoin Velocity signals lackluster involvement among market actors.

Consequently, it indicates a phase of cautious hesitation or consolidation within the cryptocurrency market.

The market is also experiencing a relaxation. In spite of higher than typical trading volumes of $2.8 billion over the previous week, the outflows, amounting to $342 million throughout the last seven weeks, underline a bleak sentiment.

Consequences: Bitcoin Future Perspective

Institutional organizations such as Genesis Trading forecast that the future expansion of trading volume will probably depend on derivatives, noting that “spot market liquidity is struggling and the depth of the spot order book is consistently diminishing.” This is not surprising, considering the declining trading volumes and investor engagement.

As the flows of crypto investment products slow down, combined with the decreasing trading volumes and diminishing search interest, it is evident that Bitcoin is traversing a phase of uncertainty.

Read more: Bitcoin Halving Cycles and Investment Approaches: What To Understand

Although may not have completely lost its shine, these indicators ought to be acknowledged. It would be wise for investors to brace for further declines or sideways movement until a convincing reason for a market surge surfaces.

Only time will reveal, considering these parameters, whether Bitcoin will restore its past brilliance or continue to fade into a period of unsettling tranquility.

Disclaimer

In compliance with the Trust Project principles, BeInCrypto is dedicated to impartial, clear reporting. This news article intends to deliver accurate, timely information. However, readers should verify facts independently and consult with a professional prior to making any decisions based on this content.

Be the first to comment