Bulls continue to dominate the overall cryptocurrency landscape as investor optimism remains aligned with policies that favor crypto, increased adoption of these digital currencies, and the strategic reserves of central banks. Nevertheless, major cryptocurrencies have primarily stagnated due to the lack of an immediate trigger.

Amid the downturn, meme tokens, especially AI ventures, have exhibited tremendous growth and undeniable prospects. iDEGEN, a distinctive social initiative, is one such venture. Even before reaching public availability, it has the capacity to challenge the likes of Fartcoin and AI16z.

Bitcoin faces pressure from expectations of fewer rate reductions

Bitcoin’s value rebounded on Tuesday after testing the critical support level of $90,000 during the preceding session. As of this writing, the leading cryptocurrency was positioned at $96,485 as it secured support near the 50-day EMA while oscillating around the short-term 20-day EMA.

While the bulls maintain their grip, rising Treasury yields have triggered a sell-off of riskier investments like cryptocurrencies. On Monday, the benchmark 10-year Treasury yields surged to 4.80%, a rate not seen since October 2023.

The stronger-than-anticipated US jobs data released late last week further suggested that the Fed might ease its rate cuts in 2025. Importantly, risk-sensitive assets like cryptocurrencies thrive in an atmosphere of reduced interest rates.

In the short term, the range between $93,010 and $97,500 will be essential to monitor. Should it surpass that level, the bulls may encounter resistance at $98,500. Conversely, a decline beyond the lower support zone could lead BTC/USD to fall to $92,225.

Bitcoin price chart | Source: TradingView

iDEGEN signifies a new chapter for AI meme tokens

As artificial intelligence transforms the cryptocurrency scene, iDEGEN represents a new dawn for AI meme tokens. In fact, based on its virality and promise, some analysts perceive it as a “Bitcoin equivalent”.

Differing from other initiatives, it launched from a clear canvas without limitations or safeguards. By leveraging degens to learn, adapt, and create tweets, iDEGEN has morphed into a viral phenomenon with growth that exceeds its creators’ wildest expectations.

So vigorous is the movement that not even a prohibition on X can stifle it. Thanks to its virality and engaged community, the project has the hallmarks of a cryptocurrency poised to transition from a mere jest to a billion-dollar entity.

Given this vast potential, an increasing number of astute investors are accumulating $IDGN tokens with only a few weeks remaining before its listing on February 27th. Since its inception on November 26th, 2024, the project has already gathered over $16 million.

Early investors are already enjoying substantial returns at its current value of $0.01. Compared to its initial price of $0.00011, $IDGN holders have garnered 8,991% in profits. At this rate, there are no indications of iDEGEN slowing its momentum. Discover more about iDEGEN here

Ethereum experiences a spike in outflows amid a shift in investor sentiment

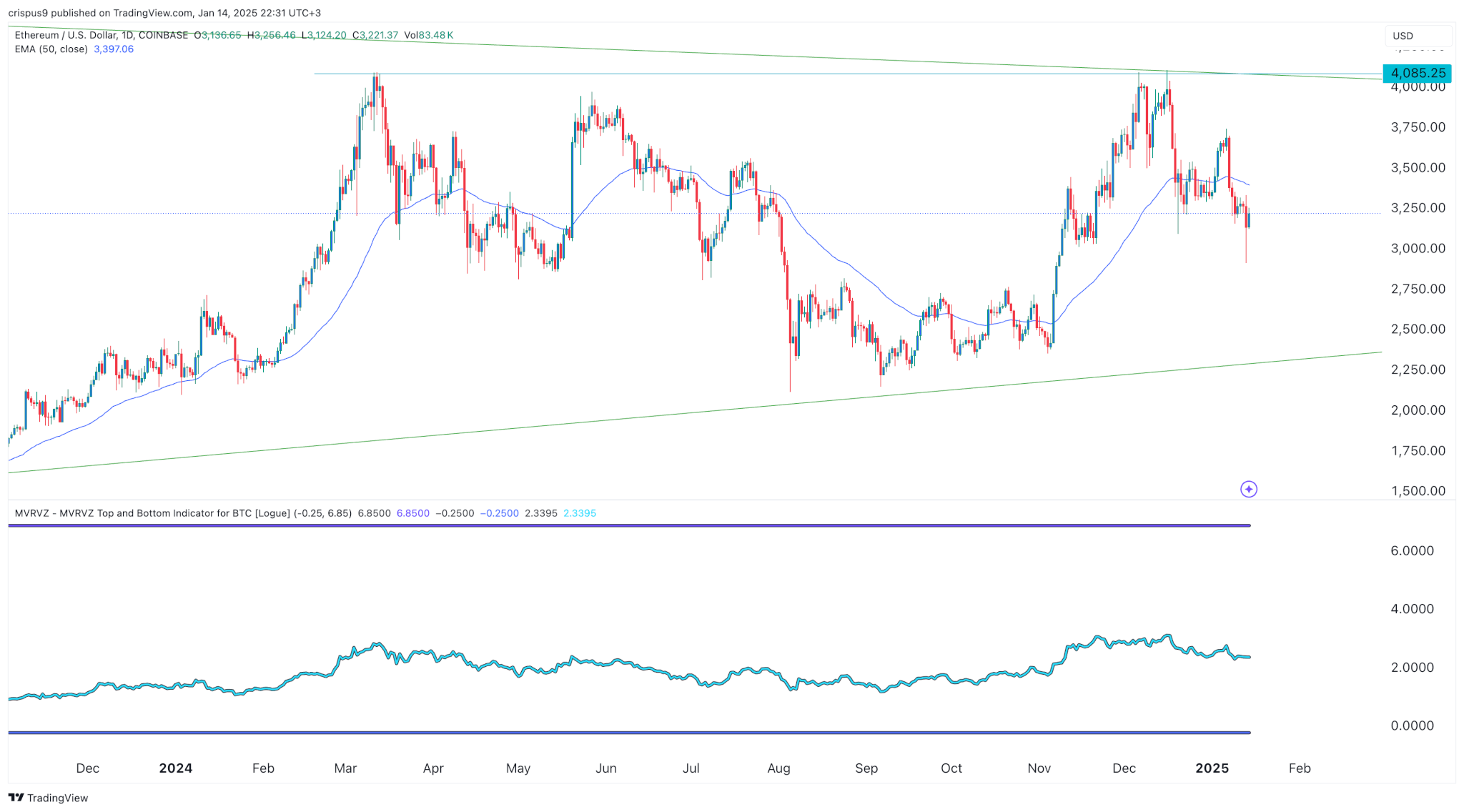

ETH price chart | Source: TradingView

Following the Bitcoin-led selloff that caused Ethereum price to briefly slip below the vital level of $3,000 on Monday, the altcoin bounced back to trade at $3,191 as of this writing. An examination of its daily chart reveals the creation of a bearish death cross, with the short-term 20-day EMA dipping below the medium-term 50-day EMA.

Additionally, ethereum price remains subjected to the recent influx of outflows. According to SoSoValue, ETH spot ETF recorded daily net outflows of $39.43 million on January 13th. Leading the charge was Grayscale Ethereum Trust EFT (ETHE) with daily net outflows of $14.49 million and cumulative net outflows totaling $3.70 billion. Simultaneously, its Mini Trust (ETH) faced daily net outflows of $37.84 million.

In the short term, ethereum price is likely to fluctuate around $3,150 as bulls attempt to sustain the support level at $3,000. Even with further upward movement, it will likely encounter significant resistance at $3,320.

Be the first to comment