Leading alternative cryptocurrency Ethereum (ETH) has been trading under $3,500 for a week, reflecting a more extensive pessimistic outlook throughout the cryptocurrency sphere. After reaching an intraday peak of $3,744 on January 6, the token’s price has dramatically fallen by 13%.

Nonetheless, in spite of the recent price decline, significant on-chain indicators imply that Ethereum investors continue to maintain a positive outlook regarding the altcoin’s short-term potential.

Ethereum Investors Stay Robust

One such metric is the rising Estimated Leverage Ratio (ELR) for ETH. According to CryptoQuant, this statistic has shown a consistent upward trajectory despite the recent price drop of ETH. Standing at 0.60 at the time of writing, ETH’s Estimated Leverage Ratio has surged by 20% over the past month, even though its price decreased by 15% during the same timeframe.

The ELR quantifies the average leverage that traders use to carry out trades on a cryptocurrency platform. It is computed by dividing the open interest of the asset by the exchange’s reserves of that currency.

ETH’s increasing ELR signifies a growing risk appetite among its traders. This illustrates that the traders of the altcoin are becoming more willing to embrace risk, notwithstanding the current price weakness. A sustained high leverage ratio indicates strong conviction among traders regarding a potential price recovery for ETH, despite facing recent challenges.

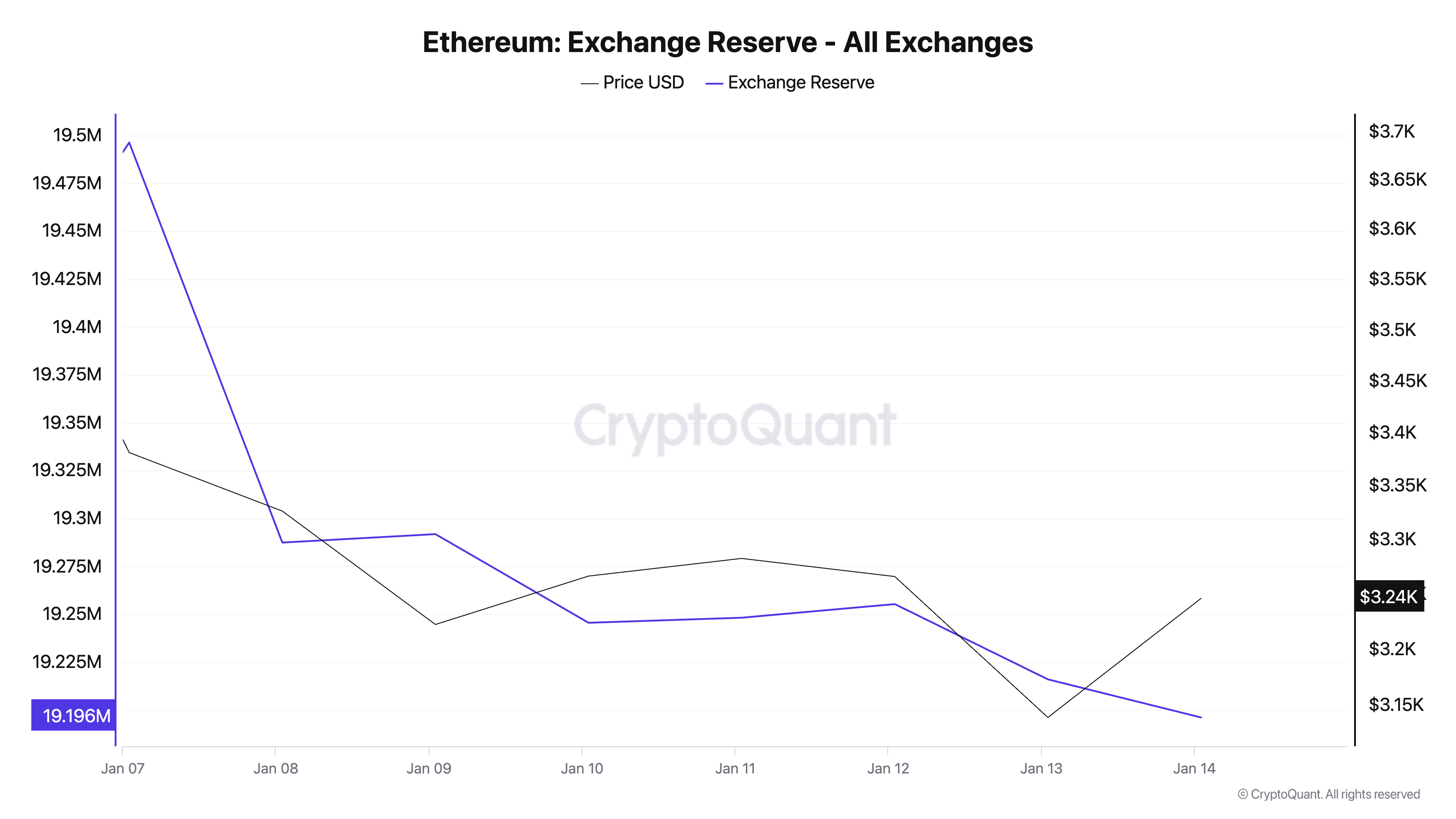

In addition, ETH’s exchange reserves have diminished to a two-month low of 19.19 million ETH, with the quantity stored in exchange wallets declining by 2% over the last week. This decrease indicates that market participants are reducing selling pressure and opting to retain their ETH tokens.

Consequently, it seems that ETH’s recent price downturn is predominantly affected by the overarching market’s negative trends rather than considerable sell-offs of ETH itself.

ETH Price Forecast: Entirely Dependent on the Larger Market

At the time of this writing, ETH is trading at $3,226, just above the support level of $3,186. Should the overall market mood improve and ETH accumulation intensifies, the price could potentially rise towards $3,563.

Conversely, if the market continues to face a decline, ETH may challenge the $3,186 support level. Should this threshold fail to withstand, the price of the token could decrease to $2,945.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis piece is intended solely for informational purposes and should not be viewed as financial or investment guidance. BeInCrypto is dedicated to precise, impartial reporting, yet market conditions can fluctuate without prior notice. Always perform your own investigation and seek advice from a professional before making any financial choices. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.

Be the first to comment