Ethereum, the second-largest digital asset, recently struggled to overcome $3,524, which led to a steep price decline. Since that point, efforts to recover have been lackluster as market fluctuations continue.

Nonetheless, the present circumstances imply that Ethereum might be gearing up for a resurgence as the market begins to stabilize.

Ethereum Has Space For Recovery

Ethereum’s Network Value to Transaction (NVT) Ratio is witnessing a decrease, recently reaching a monthly low. A low NVT suggests that transaction activity aligns with network value, showcasing reduced volatility. This fosters an environment favorable for price recovery, which Ethereum desperately needs to regain its stability.

With the NVT ratio indicating robust network activity, Ethereum is set to stabilize in the near term. Diminishing volatility typically boosts investor confidence, increasing the likelihood of renewed purchasing interest in the cryptocurrency. As speculative behaviors lessen, Ethereum has a chance to forge a route toward significant recovery.

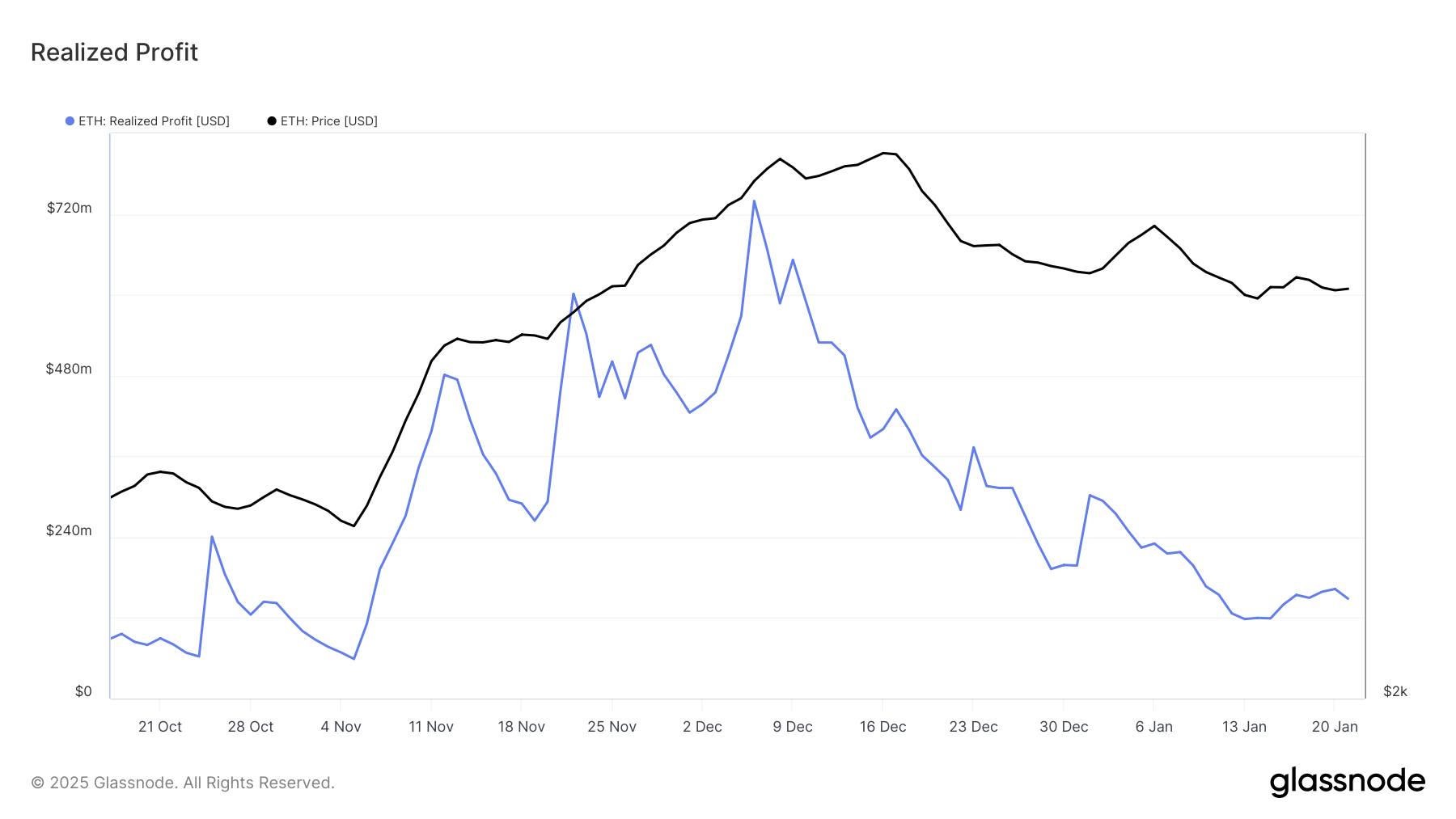

Recently, Ethereum’s realized profits have fallen to a six-week low, signaling a notable decrease in selling pressure among investors. This trend reflects a change in market sentiment, with fewer individuals aiming to liquidate their assets. Such an environment could grant Ethereum the necessary leeway to take advantage of broader optimistic signals.

The absence of an increase in realized profits implies that the current selling stagnation may continue, allowing Ethereum to concentrate on establishing upward momentum. With investors retaining their coins, market conditions are set for a steady recovery, assuming external influences remain positive.

ETH Price Forecast: Breaking The Barrier

Ethereum is presently trading around $3,300, just beneath the vital resistance point of $3,327. Transforming this level into support is crucial for ETH to trigger a rally towards $3,524, which signifies a 6% rise from current standings. This movement would symbolize a partial recovery from prior losses.

Surpassing the $3,524 resistance is critical for Ethereum’s recovery. Accomplishing this would eliminate the recent decline and position the altcoin for additional advancements, potentially reaching $3,711. Such an escalation would highlight Ethereum’s resilience and resonate with the broader market’s optimistic sentiment.

On the other hand, if $3,327 does not establish itself as a support level, Ethereum’s recovery may be hindered. This scenario would make the cryptocurrency susceptible to a pullback towards $3,200, undermining recent advancements and potentially postponing its ascent to $3,500.

Disclaimer

In accordance with the Trust Project standards, this price analysis article is solely for informational use and should not be viewed as financial or investment guidance. BeInCrypto is dedicated to providing precise, impartial reporting, but market circumstances are liable to fluctuate without notice. Always perform your due diligence and seek advice from a professional before making any financial choices. Kindly be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.

Be the first to comment