Following Strategy’s model, firms are increasingly pouring resources into Bitcoin, a trend reinforced by the digital currency’s climbing value. However, these substantial purchases give rise to apprehensions regarding potential market downturns should these firms need to divest, alongside inquiries into Bitcoin’s decentralized principles.

Representatives from Bitwise, Komodo Platform, and Sentora assert that the advantages significantly outweigh the hazards. Although minor, over-leveraged firms could face bankruptcy, their influence on the market would be minimal. They do not anticipate immediate dangers, as prosperous companies like MicroStrategy exhibit no intent of liquidating their holdings.

The Expanding Trend of Corporate Bitcoin Acquisition

The tally of companies engaging in the corporate Bitcoin purchasing trend is increasing. Recently, Standard Chartered noted that at least 61 publicly listed entities have acquired crypto, while Bitcoin Treasuries indicates the figure has escalated to 130.

As Strategy (formerly MicroStrategy) continues to amass billions in unrealized profits from its bold Bitcoin purchases, supported by a soaring Bitcoin price, more companies are expected to follow.

“The Wilshire 5000 equity index literally encompasses 5000 publicly listed companies in the US alone. It is quite plausible that we will witness a substantial acceleration in corporate treasury Bitcoin adoption this year and in 2026 as well,” André Dragosch, Research Head for Bitwise in Europe, communicated to BeInCrypto.

The factors driving his belief are numerous.

How Does Bitcoin’s Fluctuation Compare to Other Assets?

Despite its volatility, BTC has historically produced exceptionally high returns in comparison to conventional asset categories such as stocks and gold.

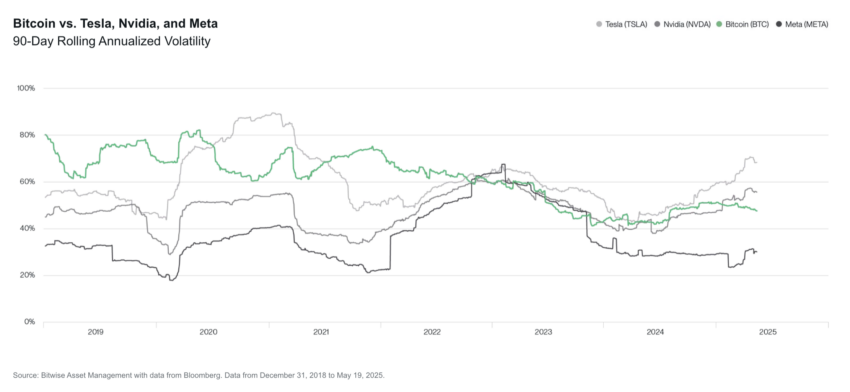

“A particularly intriguing data point is the volatility of Bitcoin versus leading tech stocks, such as Tesla and Nvidia. Many investors claim, ‘I would never put my money in something as inconsistent as Bitcoin,’” Ryan Rasmussen, Head of Research at Bitwise, explained, adding, “Meanwhile, most investors privately hold Tesla and Nvidia (either directly or through index funds like the S&P 500 and Nasdaq-100). In recent months, both Tesla and Nvidia have displayed greater volatility than Bitcoin.”

Although past results do not guarantee future profits, BTC current performance, which has been notably stable, may inspire more organizations to acquire the asset.

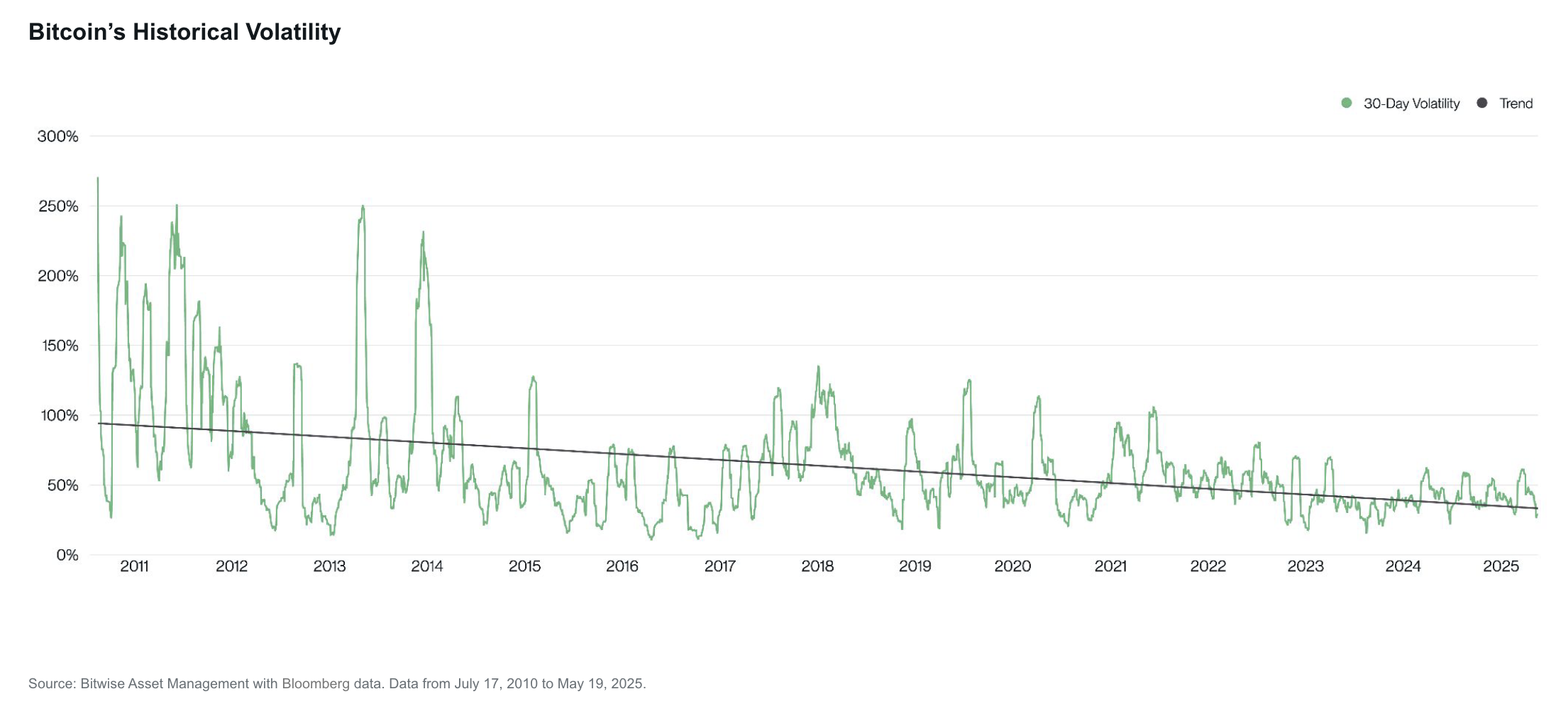

“Bitcoin’s volatility has diminished over time—a trajectory we expect to persist for the foreseeable future. As Bitcoin uncovers its true value, the volatility will decrease to nearly zero, at which point demand could begin to slow. As long as volatility exists in Bitcoin, it could very well continue appreciating over the long term, based on historical data,” Kadan Stadelmann, Chief Technology Officer at Komodo Platform, suggested to BeInCrypto.

Simultaneously, as global markets contend with economic difficulties, BTC may emerge as an attractive option for enhancing weakened financial balance sheets.

Will Bitcoin Surpass Traditional Safe Havens?

The United States and the broader global economy have faced geopolitical strains, surging inflation rates, and concerning fiscal deficits. Recognized as “digital gold” and a sovereign-neutral store of wealth, BTC has captured the interest of various stakeholders, particularly following Strategy’s success.

“As more companies embrace such a corporate policy, pressure from existing shareholders will undoubtedly rise over time, especially if inflation rates begin to accelerate again due to heightened geopolitical risks and rising fiscal debt managed by central banks. Many firms are also operating within a saturated, low-growth sector characterized by significant debt where Bitcoin adoption could certainly enhance returns for current shareholders,” Dragosch elucidated.

He predicted that the moment Bitcoin outpaced traditional safe havens like US Treasury bills and gold would eventually arrive. As adoption grows, BTC volatility will decrease, rendering it a compelling asset.

“The volatility of BTC has been on a consistent downward trend since its inception. The primary factors behind this structural reduction are increasing scarcity due to halving events and growing adoption, which tends to mitigate volatility. We expect Bitcoin’s volatility to ultimately align with gold’s volatility and become a dominant alternative store-of-value and reserve asset,” he stated.

Meanwhile, BTC technological foundation will also provide it with a competitive advantage over other asset classes.

“Given its technological superiority compared to gold, we believe there is a substantial likelihood that Bitcoin could eventually displace gold and other stores of value like US Treasury bonds in the long run. This will become increasingly significant in light of rising global sovereign debt risks,” Dragosch added.

However, not every company is alike. While some may gain, others may not.

Differentiating Corporate BTC Initiatives

According to Rasmussen, there are two categories of BTC treasury companies.

Lucrative enterprises channeling surplus funds, such as Coinbase or Square, or entities that procure debt or equity to acquire BTC. No matter the category, their accumulation enhances BTC demand, elevating its value in the short term.

Profitable enterprises that purchase BTC using surplus funds are rare and pose no systemic threat. Rasmussen expects these firms to keep accumulating BTC over the long haul.

Entities that turn to debt or equity may encounter a different outcome.

“Bitcoin financing companies only exist because public markets are willing to pay more than $1 for $1 of Bitcoin exposure. This is unsustainable long-term unless these companies can increase their Bitcoin per share. Issuing equity to purchase Bitcoin does not increase BTC per share. The only method to boost Bitcoin per share is to issue convertible debt or preferred stock,” Rasmussen clarified.

The success rates of these firms hinge on their profitability to cover their debts.

Reducing Corporate Bitcoin Risk

Larger, established corporations generally possess greater resources than smaller ones to manage their liabilities.

“The large and recognized BTC treasury companies, like Strategy, Metaplanet, and GameStop, ought to be capable of refinancing their debt or issuing equity to gather cash for debt repayment with relative ease. The smaller and lesser-known firms that lack profitable operations are most at risk of needing to liquidate Bitcoin to fulfill their obligations,” he added.

According to Dragosch, the key to evading this situation for smaller companies lies in preventing overleveraging. In simpler terms, only borrow what you can repay.

“The crucial aspect that often disrupts any type of business strategy is overleverage… potential threats are more likely with other firms that are imitating MSTR’s Bitcoin acquisition strategy and begin with a higher cost basis. This heightens the risk of forced sales and bankruptcy in the next downturn, particularly if these companies accumulate excessive debt in the process and overextend themselves,” he stated.

Nevertheless, these liquidations would minimally impact the market.

“That would generate short-term fluctuations for Bitcoin and adversely affect these companies’ stock values, but it’s not a catastrophic risk for the wider crypto ecosystem. It will likely involve a relatively small number of minor firms needing to sell a comparatively insignificant amount of Bitcoin to settle their debts. In such a case, the market will hardly respond,” Rasmussen remarked.

The genuine issue surfaces when major players opt to liquidate their holdings.

Are Substantial Holdings a Systemic Risk?

As more companies add BTC to their balance sheets, it fosters decentralization, at least on the market level. Strategy is no longer the sole corporation adopting this approach.

That being said, Strategy’s holdings are massive. Currently, it possesses nearly 600,000 BTC – 3% of the total supply. Such centralization indeed carries liquidation risks.

“More than 10% of all BTC is now held in ETF custodial wallets and corporate treasuries; a significant share of the overall supply. This concentration introduces a systemic threat: if any of these centrally managed wallets are compromised or mismanaged, the repercussions could ripple through the entire market,” Juan Pellicer, Vice President of Research at Sentora, informed BeInCrypto.

Some specialists believe such a scenario is improbable. If it were to occur, Stadelmann predicts the initial negative impacts would ultimately stabilize.

“If MicroStrategy were to sell a substantial portion of its Bitcoins, it would formulate a plan to do so discreetly without impacting the market initially. Eventually, people will grasp what is transpiring, leading to a wider sell-off and lowered BTC prices. However, the declining values, coupled with Bitcoin’s capped supply of only 21 million coins, will drive demand for Bitcoin from various participants, including other corporations and nation-states,” he stated.

Nonetheless, the considerable quantity of BTC held by a select few large corporations raises fresh concerns about the centralization of the asset itself rather than issues of competition.

Centralization as a Trade-Off for Adoption

Large corporate accumulation raises worries about the concentrated ownership of BTC’s finite supply. This challenges a fundamental DeFi principle and induces anxiety over the disruption of its foundational framework.

According to Dragosch, this is not accurate. Ownership of the majority of the supply does not grant one the capacity to alter Bitcoin’s rules.

“The merit of Bitcoin’s proof-of-work consensus mechanism is that possessing the majority of the supply does not permit rule changes, which distinguishes it from other crypto-assets such as Ethereum. In Bitcoin’s case, a majority of hash rate is needed to amend consensus regulations or corrupt/attack the network. Institutions investing in Bitcoin must adhere to Bitcoin’s protocol rules, after all,” he explained.

Conversely, Pellicer acknowledges some validity in these concerns. However, he perceives them as a necessary compromise for the other benefits associated with broader adoption.

“While this centralization contradicts Bitcoin’s ethos of individual, self-sovereign ownership, institutional custody could still represent the most practical route to widespread adoption, offering the regulatory clarity, liquidity, and user-friendliness that many new entrants anticipate,” he remarked.

With companies increasingly utilizing BTC for strategic financial advantages, its journey towards becoming a universally accepted reserve asset is quickening. For the moment, the threat of a market collapse appears to be under control.

Disclaimer

In accordance with the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals.

“`

Be the first to comment