One of the most discussed subjects in today’s financial landscape is Bitcoin inflows, as investors show increasing enthusiasm for cryptocurrencies.

The leading cryptocurrency Bitcoin (BTC) has experienced a significant increase in inflows from US investors prior to Donald Trump’s inauguration on Monday.

This pattern implies that American investors are actively acquiring BTC, indicating a rising confidence in its upward price movement once Trump officially takes office as president.

Bitcoin Experiences Heightened Demand from American Investors

The increasing Coinbase Premium Index for Bitcoin underscores the growing interest for the dominant coin among American investors. As reported by CryptoQuant, this has surged by 116% over the past week, currently positioned above the zero line at 0.02.

Bitcoin’s Coinbase Premium Index assesses the price difference between BTC on Coinbase and Binance. A rise in the index signals stronger buying pressure from US investors, demonstrating elevated demand in that region.

This surge is occurring just before Donald Trump’s inauguration on Monday. The pro-cryptocurrency candidate’s return to the White House has sparked speculation regarding potential positive regulatory changes, generating increased interest in Bitcoin among American investors.

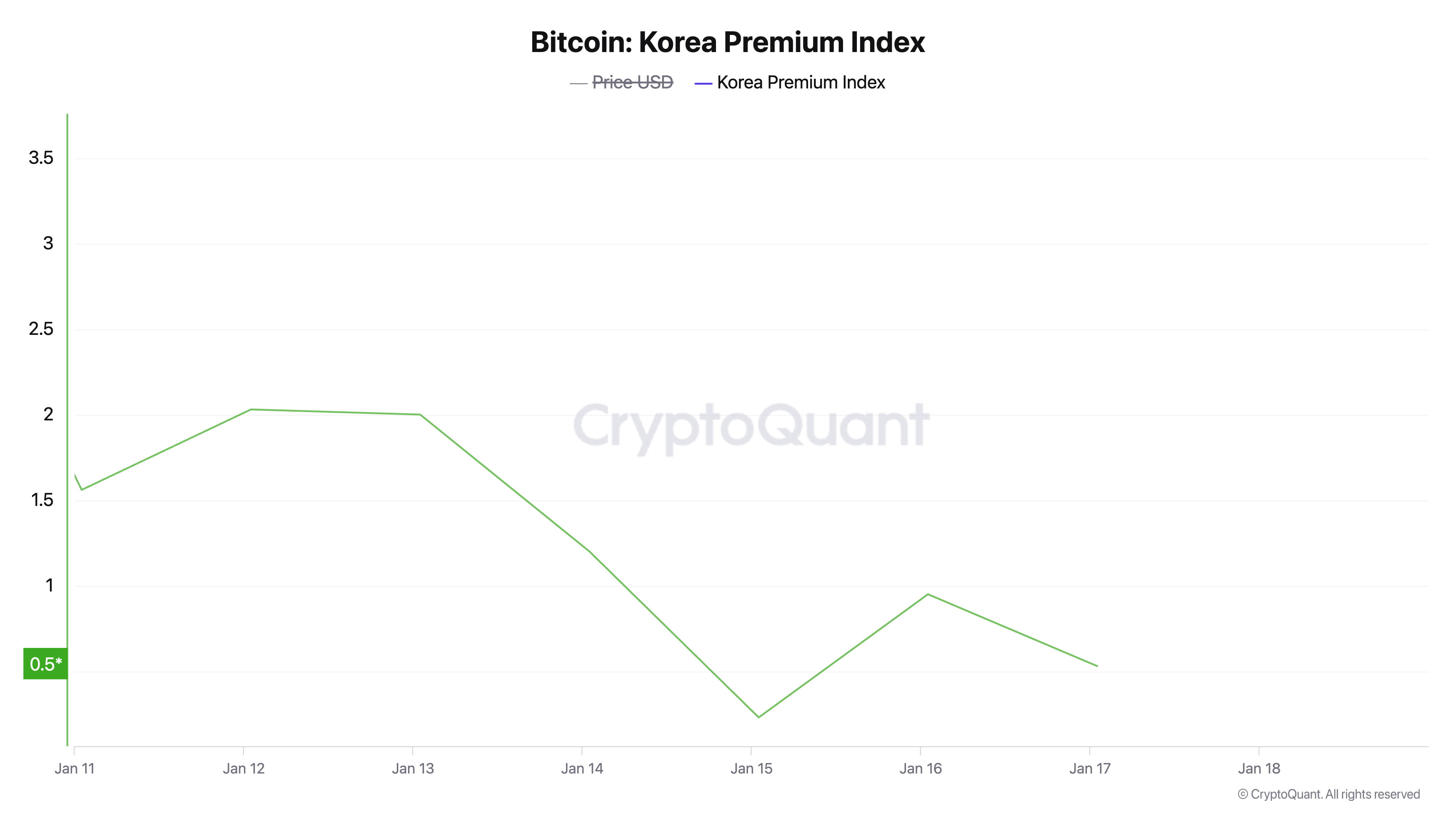

In contrast, Asian investors seem more reserved. The Korean Premium Index, which reflects the price disparity of BTC on Korean exchanges, is on the decline. At the time of writing, it stands at 0.53, having fallen by 66% over the past week.

This decrease suggests diminished buying activity in the region, likely affected by the current phase of market consolidation.

BTC Price Forecast: All-Time High on the Horizon

According to the daily chart, BTC is presently trading at $103,107, slightly over the significant resistance established at $102,538. Should the accumulation of coins by US investors continue, it could provide the necessary momentum for the leading coin to aim for its all-time high of $108,388.

Nonetheless, if purchasing activity declines, this may exert downward pressure on the asset’s price, potentially leading it to drop toward $95,513.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article intends for informational purposes only and should not be perceived as financial or investment advice. BeInCrypto is devoted to delivering accurate and unbiased reporting; however, market conditions may evolve without prior notice. Always perform your own due diligence and consult with a professional before making any financial decisions. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.

Be the first to comment