The Bank of Japan (BOJ) revealed a groundbreaking 25 basis point (bp) increase, elevating its benchmark lending rate to 0.5%, the most elevated level since 2008.

While this action was largely expected, it has left traders and investors anxious, preparing for its ramifications on Bitcoin and the cryptocurrency markets as a whole.

Rate Increase by BOJ and Worldwide Financial Ramifications

This decision by the BOJ signifies the third rate increase since the start of 2024. This indicates a transformation in Japan’s monetary policy in response to ongoing high inflation, which is projected to linger between 2.6% and 2.8% in 2025.

Consequently, predictions for Japan’s economic growth have been adjusted downward, complicating an already unstable financial landscape. A strengthened Japanese currency that arises from the rate hike could potentially disrupt the yen carry trade.

In the carry trade approach, investors obtain yen at low interest rates to allocate to assets yielding higher returns elsewhere. This unwinding may activate a chain reaction affecting global liquidity, impacting risk assets, which encompass cryptocurrencies, equities, and commodities.

Post-announcement, Bitcoin declined by 3%, but is already striving for a rebound. Ethereum, Solana, Dogecoin, and Cardano witnessed corrections as well. The shift in sentiment is likely linked to President Donald Trump’s executive directive regarding a digital assets reserve in the US.

The immediate decrease illustrates Bitcoin’s responsiveness to macroeconomic shifts, with investors reducing their involvement in high-risk assets. Still, some analysts foresee additional downward movement for Bitcoin once the excitement surrounding systemic changes in the US wanes.

“Bitcoin could undergo a steep 50% decline,” crypto analyst Financelancelot conjectured.

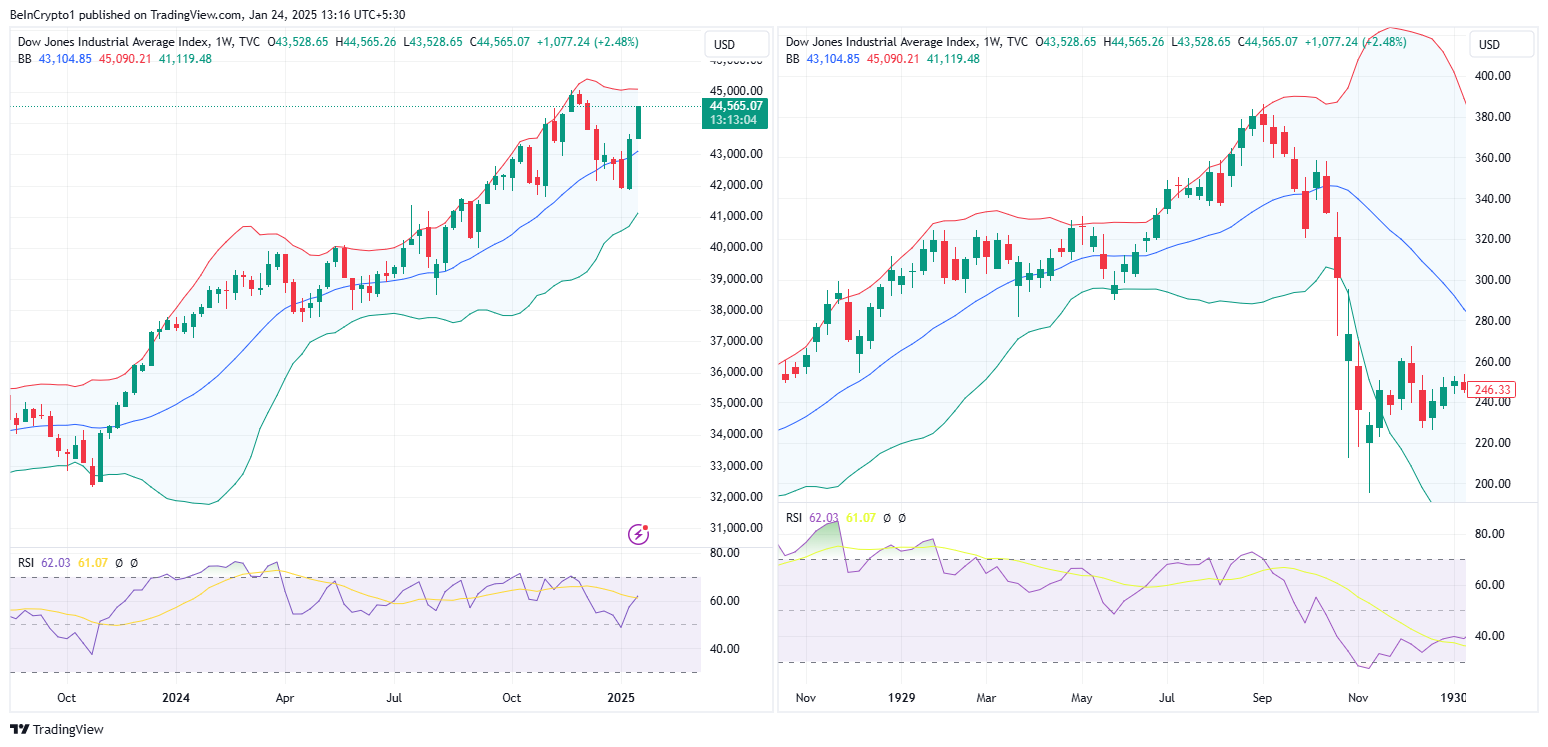

The analyst draws comparisons to the 1929 stock market crash, which underscored the perils of speculative bubbles. They pointed out notable similarities in technical indicators such as the Relative Strength Index (RSI), which currently reflects those from 1929. With this, the analyst anticipates a potential flash crash towards the end of January 2025.

Financelancelot notes that factors like the expiration of VIX options and geopolitical tensions could heighten volatility. Conversely, certain figures in the cryptocurrency realm, such as @0xKiryoko, maintain a cautiously hopeful outlook.

“…global markets are going to feel it. Crypto included. Solana ETFs and a pro-crypto president won’t matter in the short term if liquidity diminishes…but the bullrun is not finished. NFA, opportunities like this don’t come neat and simple,” she remarked.

In the meantime, the BOJ’s rate increase is just one element affecting the cryptocurrency market. Global uncertainties, including US trade policies and geopolitical occurrences, are contributing additional layers of intricacy. Cypress Demanincor, another market analyst, highlighted that the Trump administration’s economic tactics are generating extra volatility.

“Everyone’s focus was on the Trump inauguration for the next significant market shift while the more substantial force to consider is the BOJ interest rate escalation,” he stated.

As the BOJ’s rate increase takes effect, traders and investors must observe its consequences. Historically, such moves, when a reverse carry trade occurs, have led to temporary sell-offs followed by recuperation periods.

“The same situation that transpired on July 31st, 2024. Brief selling pressure and depreciated prices that linger a few days depending on the scale of the unwind. Previously, it lasted about a week’s worth of selling pressure,” added Demanincor.

The current climate underscores the necessity of caution and strategic foresight for cryptocurrency investors. While the market may confront impending volatility, it might also offer chances to amass assets at lower prices.

“I sympathize with everyone who got shaken out of the markets over the past few days due to concerns surrounding the BOJ, and the absence of Strategic Bitcoin Reserve updates. Investors need to keep a longer outlook in mind if they strive to achieve success. Patience will be rewarded. Remember, 10 days yield the highest gains in the Bitcoin cycle. Good luck trying to perfectly time that,” remarked one crypto investor.

Disclaimer

In compliance with the Trust Project guidelines, BeInCrypto is dedicated to unbiased and transparent reporting. This news article seeks to deliver accurate and timely information. However, readers are encouraged to verify facts independently and consult with a professional before initiating any decisions based on this content. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.

Be the first to comment