The Bitcoin (BTC) market demonstrated considerable volatility in the past week as a price drop beneath $75,000 was succeeded by a surge above $83,000. With the leading cryptocurrency showcasing signs of a continued upward trend, blockchain analytics company CryptoQuant has pinpointed two significant resistance areas awaiting action.

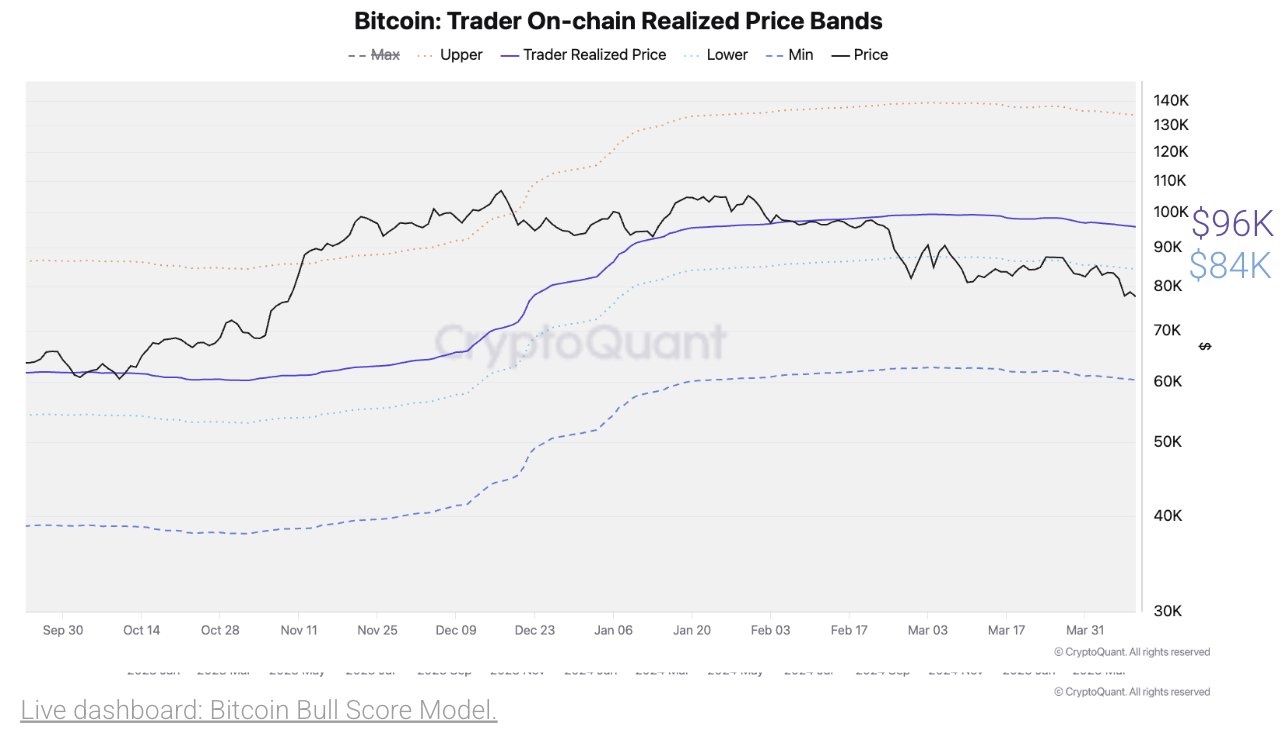

Bitcoin Realized Price Indicates Potential Strong Obstacles At $84,000 And $96,000

In an X post dated April 11, CryptoQuant presented an on-chain analysis regarding the BTC market suggesting a possible confrontation with two primary resistances at $84,000 and $96,000 if Bitcoin sustains its present upward path. These price thresholds are indicated by the Realized Price metric which represents the average price at which the existing supply of BTC last transacted on-chain, thereby establishing the market-wide cost foundation.

When Bitcoin trades above this threshold, it signifies a robust bullish momentum with a majority of holders realizing a profit. On the flip side, when BTC is below this mark, it suggests negative sentiment since most investors are facing losses. Consequently, the Realized Price frequently serves as a critical market pivot, acting as strong support during bullish markets and formidable resistance during bearish phases. According to Julio Moreno, CryptoQuant’s Head of Research, BTC’s current on-chain realized price stands at $96,000 with an immediate lower price range of $84,000.

Notably, these two price points have acted as essential support areas in the previous bullish cycle of the current market phase. Nevertheless, there exists the possibility for both levels to function as resistance amid the ongoing market correction. However, should Bitcoin manage to breach $84,000 and $96,000, it could indicate the resurgence of the bull market with the potential for the premier cryptocurrency to escalate as high as $130,000. This anticipated increase would equate to a 55% rise in current market valuations.

BTC Price Summary

At the time of writing, Bitcoin is trading at $83,180, reflecting a 3.65% increase in the last day. Simultaneously, the daily trading volume has declined by 11.99% and is valued at $39.19 billion.

Amid persistent macroeconomic changes influenced by US Government tariff adjustments, the crypto market continues to exhibit a notable level of uncertainty, and assets are struggling to establish a clear momentum. However, blockchain analytics firm Glassnode indicates that Bitcoin investors have built a strong support area at $79,000 and $82,080, where over 40,000 BTC and 51,000 BTC have been accumulated consecutively.

In the event of any downward trend, both price points are set to provide short-term support and avert further price declines. Boasting a market capitalization of $1.66 trillion, Bitcoin remains the foremost digital asset, constituting over 60% of the cryptocurrency market cap.

Featured image from CNN, chart from Tradingview.com

The editorial process for bitcoinist focuses on delivering thoroughly researched, precise, and impartial content. We adhere to stringent sourcing standards, and every page is meticulously reviewed by our team of leading technology specialists and experienced editors. This approach assures the integrity, relevance, and value of our content for our audience.

The editorial process for bitcoinist focuses on delivering thoroughly researched, precise, and impartial content. We adhere to stringent sourcing standards, and every page is meticulously reviewed by our team of leading technology specialists and experienced editors. This approach assures the integrity, relevance, and value of our content for our audience.

Be the first to comment