“`html

The market behavior of Bitcoin over the prior week was predominantly positive, as the leading cryptocurrency regained its position above the significant $100,000 threshold. This latest surge of optimistic momentum reflects a solidly improving sentiment among investors.

On Friday, May 15, the Bitcoin price peaked at $103,800 — marking its highest point since January. Nevertheless, the most recent on-chain statistics reveal a deficiency of investor engagement in the derivatives sector, which is typically observed when BTC’s price reaches this range.

BTC Price Surge Facing Potential Hurdle?

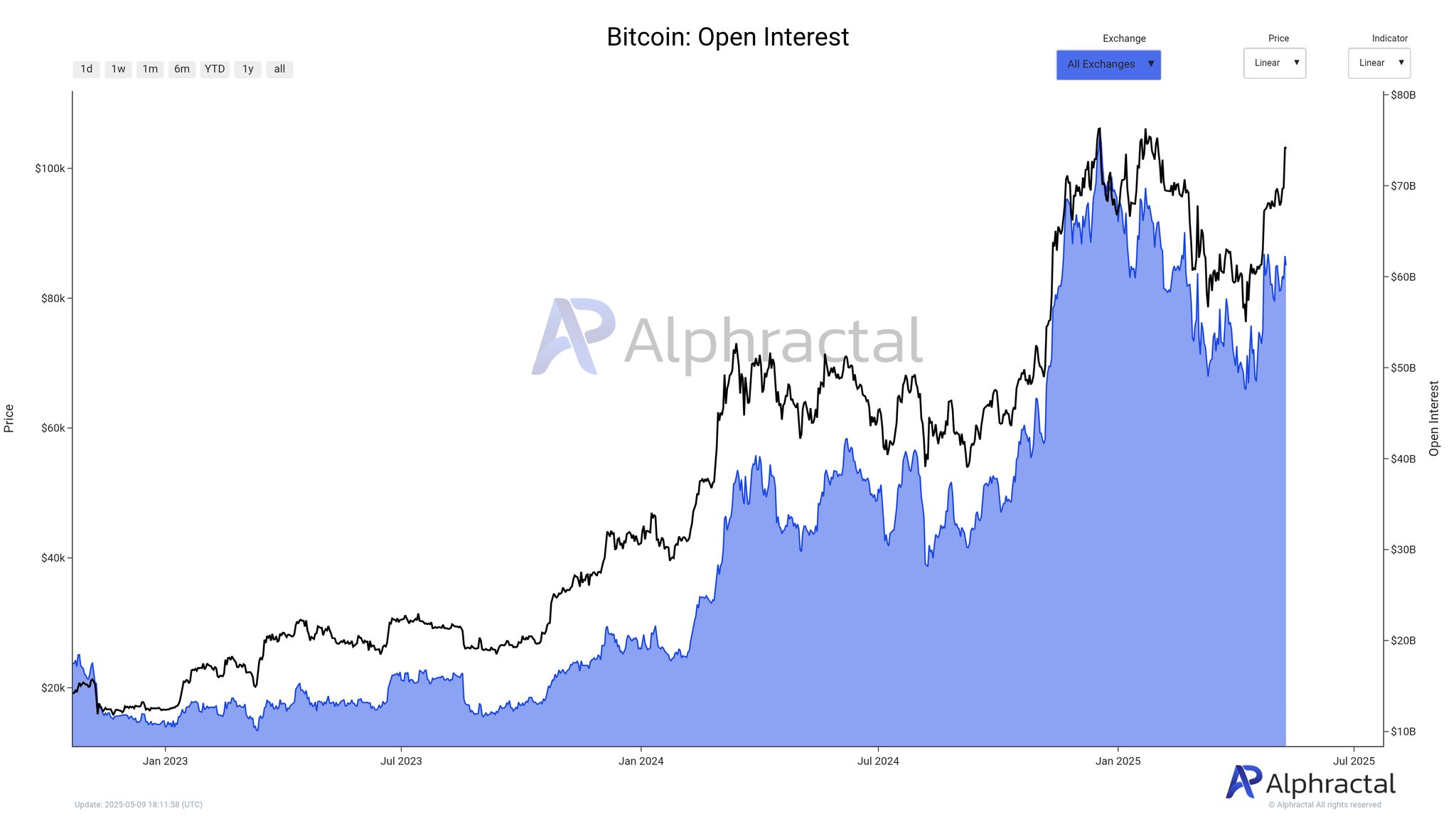

In a recent update on the social media site X, crypto analysis platform Alphractal disclosed that the open interest (OI) has not significantly aligned with the Bitcoin price movements in the last few days. The open interest parameter indicates the total sum of funds flowing into BTC derivatives at any moment.

Increasing open interest is often deemed a bullish indicator for the leading cryptocurrency, particularly as it implies new capital infusions into the marketplace. Ultimately, this trend signifies enhanced investor sentiment and escalating trader confidence.

Data from Alphractal indicates that the current total OI for Bitcoin (approximately $103,000) is around $61.3 billion. The last instance BTC reached this significant price, the open interest surpassed $68 billion.

Source: @Alphractal on X

With the current Bitcoin open interest being lower than the OI from the last time the price was at $103,000, Alphractal pointed out that this trend suggests diminished leverage and decreased activity in the cryptocurrency’s largest sector. The analytics company further clarified that this occurrence could stem from recent liquidation waves or position closures.

In the post on X, Alphractal shared additional factors that might put the flagship cryptocurrency’s price at risk of a short-term correction. The pertinent on-chain metric supporting this pessimistic outlook is the Whale Position Sentiment.

The Whale Position Sentiment metric monitors both the directional inclination and trading habits of substantial holders. It generally reflects the net positioning of whales, their market perception, and also variations in open positions.

Chart exhibiting a drop in the Whale Position Sentiment from 1 to around 0.7 | Source: @Alphractal on X

Alphractal concluded that the reduction in the Whale Position Sentiment signifies large investors’ intention to close long positions, consequently altering market sentiment. Should the metric persist in its decline, the on-chain analytics firm inferred that it could result in price stagnation, or potentially, a correction.

Bitcoin Price Overview

At the time of this writing, the price of BTC is $103,035, indicating no noteworthy fluctuations in the last 24 hours. While the recent bullish momentum indicates that the leading cryptocurrency may reach a new all-time high soon, investors should proceed with caution, reflecting on recent on-chain insights.

The price of BTC on the daily timeline | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

The editorial process for bitcoinist focuses on delivering thoroughly examined, precise, and impartial content. We adhere to stringent sourcing standards, and each page undergoes careful scrutiny by our team of leading technology experts and veteran editors. This approach guarantees the integrity, relevance, and value of our content for our audience.

The editorial process for bitcoinist focuses on delivering thoroughly examined, precise, and impartial content. We adhere to stringent sourcing standards, and each page undergoes careful scrutiny by our team of leading technology experts and veteran editors. This approach guarantees the integrity, relevance, and value of our content for our audience.

“`

Be the first to comment