Bitcoin skyrocketed to a record peak of $116,000 on July 10, merely six days following Donald Trump’s endorsement of the Big Beautiful Bill into legislation. The leading cryptocurrency has ascended by 6% since the bill’s endorsement, with Ethereum and other alternative coins closely trailing.

This surge occurs amidst a series of macroeconomic transformations, escalating US debt, constricting bond markets, and unprecedented ETF inflows.

Fiscal Surge Triggers Flight to Hard Assets

Trump’s $3.3 trillion Big Beautiful Bill, which was ratified on July 4, prompted an instantaneous $410 billion increase in US debt. The legislation elevates the debt ceiling by $5 trillion and permanently prolongs significant tax reductions.

Markets perceive this as inflationary. Investors are shifting from bonds to limited assets like Bitcoin. The magnitude and rapid execution of the bill have intensified concerns regarding financial discipline.

Bitcoin, with its capped supply, is re-emerging as a safeguard against fiat depreciation.

BlackRock’s spot Bitcoin ETF (IBIT) has amassed $76 billion in assets under management. That’s three times what it held just 200 trading days earlier.

In contrast, it took the largest gold ETF over 15 years to achieve a similar milestone. Institutional investments are now a formidable force driving price dynamics, integrating Bitcoin more deeply into mainstream portfolios.

Fed Balance Sheet Contraction Tightens Liquidity

In June, the Federal Reserve curtailed its balance sheet by $13 billion, reducing it to $6.66 trillion—the lowest level since April 2020. The Fed has diminished over $2.3 trillion in assets during the past three years.

Simultaneously, Treasury holdings have plummeted by $1.56 trillion over that time. With diminished purchasers in the bond market and increased debt issuance, investors are transitioning to alternative stores of value.

Bitcoin has emerged as the primary option.

Additionally, Ethereum is trading near $3,000, having risen 14% since the enactment of the Big Beautiful Bill. Solana, Avalanche, and other alternative coins are also experiencing significant gains.

Retail and institutional investments are re-entering the market. Meme coins and DeFi tokens are gaining popularity as speculative interest returns. Crypto is once more at the forefront of the risk-on trend.

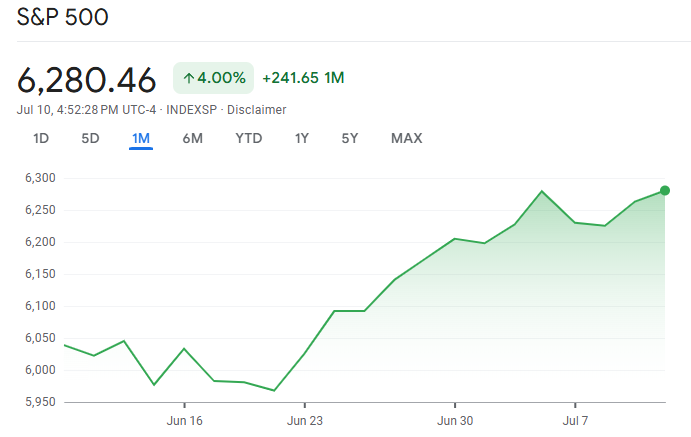

S&P 500 All-Time High: Risk-On Across the Board

The S&P 500 has ascended 30% since its April 2025 low, reaching a new all-time peak this week. This demonstrates robust investor confidence in high-growth, high-risk assets.

Bitcoin benefits directly from this atmosphere. As equities climb, crypto usually follows suit. The market views the Big Beautiful Bill as indirect stimulus—and it’s reacting in kind.

Bottom Line

Bitcoin’s most recent all-time peak is a reflection of structural modifications—not mere excitement. The Big Beautiful Bill has increased the deficit and shaken confidence in US debt markets.

With inflation apprehensions escalating and institutional access widening, Bitcoin is becoming the macro hedge of choice. As crypto enters a new bullish phase, all attention now shifts to the Federal Reserve and interest rate strategies.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto pledges to impartial, transparent reporting. This news article endeavors to deliver accurate, timely information. Nevertheless, readers are encouraged to verify facts independently and seek advice from a professional prior to making any decisions based on this material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment