Ether declined by 9%, XRP dropped 2%, and Dogecoin experienced a decrease of over 8% within 24 hours.

Investors respond to Trump’s remarks concerning a potential recession.

The US stock market saw a decline exceeding $1.7 trillion in worth.

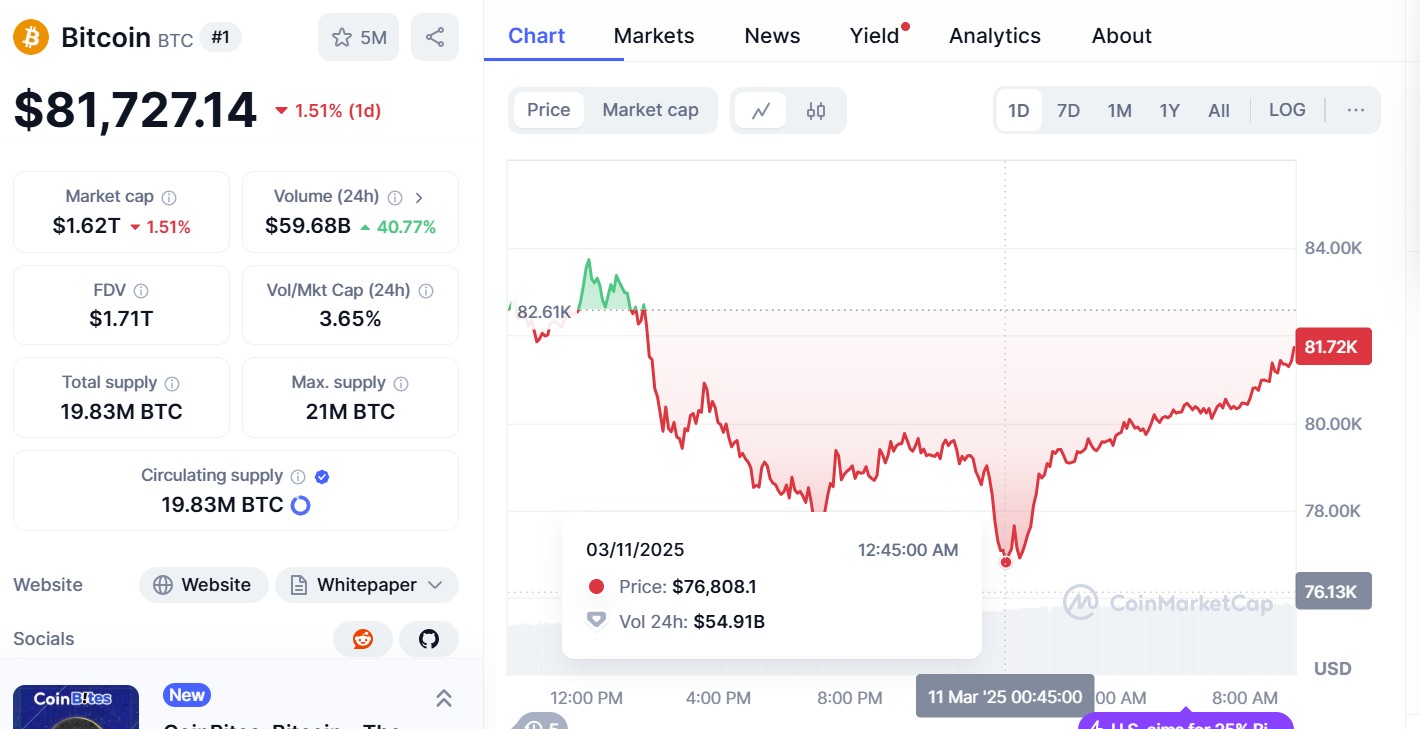

Bitcoin Plummets to $76K

Cryptocurrency values have plummeted overall, with Bitcoin slipping below $77,000 as investors continued to react to US President Donald Trump’s tariff strategies and the Bitcoin reserve initiative.

In the early morning of Tuesday, March 11, Bitcoin plunged to $76,000, a level not seen since last September. In a message on X, crypto trader Ali commented:

“If #Bitcoin $BTC maintains $80,000, the bullish argument stays robust. However, losing this mark could bring $69,000 into play as the next significant support!”

https://twitter.com/ali_charts/status/1899267277654229041

Bitcoin has slightly increased and is now approximately $81,600 at the time of this report, according to CoinMarketCap. Conversely, Ether was down over 9% in the past 24 hours to $1,920, XRP had decreased more than 2% to $2.13, and Dogecoin fell over 8.81% to $0.1607.

The market responds

The news about the ongoing market decline emerges as investors react to Trump’s trade tariffs, the declaration of the US Strategic Bitcoin Reserve, and the potential of a recession.

After Trump’s statements, the US stock market suffered a loss of more than $1.7 trillion in worth yesterday. Elon Musk’s Tesla witnessed a share price drop of at least 15% to $222, representing over half its value from its December peak of $479.86. In a message on X, Musk stated: “it will be fine long-term.”

Market conditions have not been facilitated by Trump’s trade tariffs on Canada, China, and Mexico. Last month, it was reported that Trump was enforcing a 25% trade tariff on Canada and Mexico; however, this has been postponed until April 2. A 20% tariff was imposed on China.

BitMEX co-founder Arthur Hayes took to X to urge individuals to be “patient.”

“$BTC likely bottoms around $70k. 36% correction from $110k ATH is very typical for a bull market,” he added:

“Traders will attempt to buy the dip; if you are more risk-averse, wait for the central banks to ease before deploying further capital. You may not hit the bottom, but you also won’t have to mentally endure a prolonged period of stagnation and potential unrealized losses.”

Be the first to comment