The market supremacy of Bitcoin (BTC) has skyrocketed to 64%, hitting its peak level in more than four years.

Nevertheless, analysts are split on the significance of this development for the future. Some foretell an upcoming altcoin season, while others warn that Bitcoin’s dominance could keep altcoins in check.

What Does the Increase in Bitcoin’s Dominance Indicate?

To provide context, Bitcoin dominance (BTC.D) denotes the portion of the entire cryptocurrency market valuation attributed to BTC. It serves as a crucial indicator of Bitcoin’s power in relation to other cryptocurrencies. An increase in dominance implies that Bitcoin is surpassing altcoins, whereas a decline might indicate heightened interest or investment in alternative digital assets.

This metric has been rising consistently since late 2022. According to the most recent figures, it surged to 64%, achieving levels not observed since early 2021.

Interestingly, Benjamin Cowen, the founder of Into The Cryptoverse, noted that this figure is significantly higher when stablecoins are excluded.

“When excluding stable coins, Bitcoin dominance stands at 69%,” Cowen disclosed.

The uptick in Bitcoin dominance has triggered discussions among experts regarding its impact on altcoins. Cowen is of the opinion that there will be a correction or decline in altcoins prior to any noteworthy profits being seen in the market. This suggests that the altcoin season may not be just around the corner.

“I believe that ALT/ BTC pairs must decrease before they can rise,” he asserted.

Nordin, the creator of Nour Group, also expressed caution. He emphasized that Bitcoin dominance is approaching levels witnessed during the peak of the 2020 bear market.

“This isn’t merely a BTC movement. It’s capital shifting away from alts,” he pointed out.

Additionally, Nordin cautioned that a rise above 66% could heighten selling pressure on altcoins, potentially postponing the altcoin season.

“Bitcoin dominance hovers at 64%. There will be no Alt seasons in 2024 or 2025,” analyst Alessandro Ottaviani predicted.

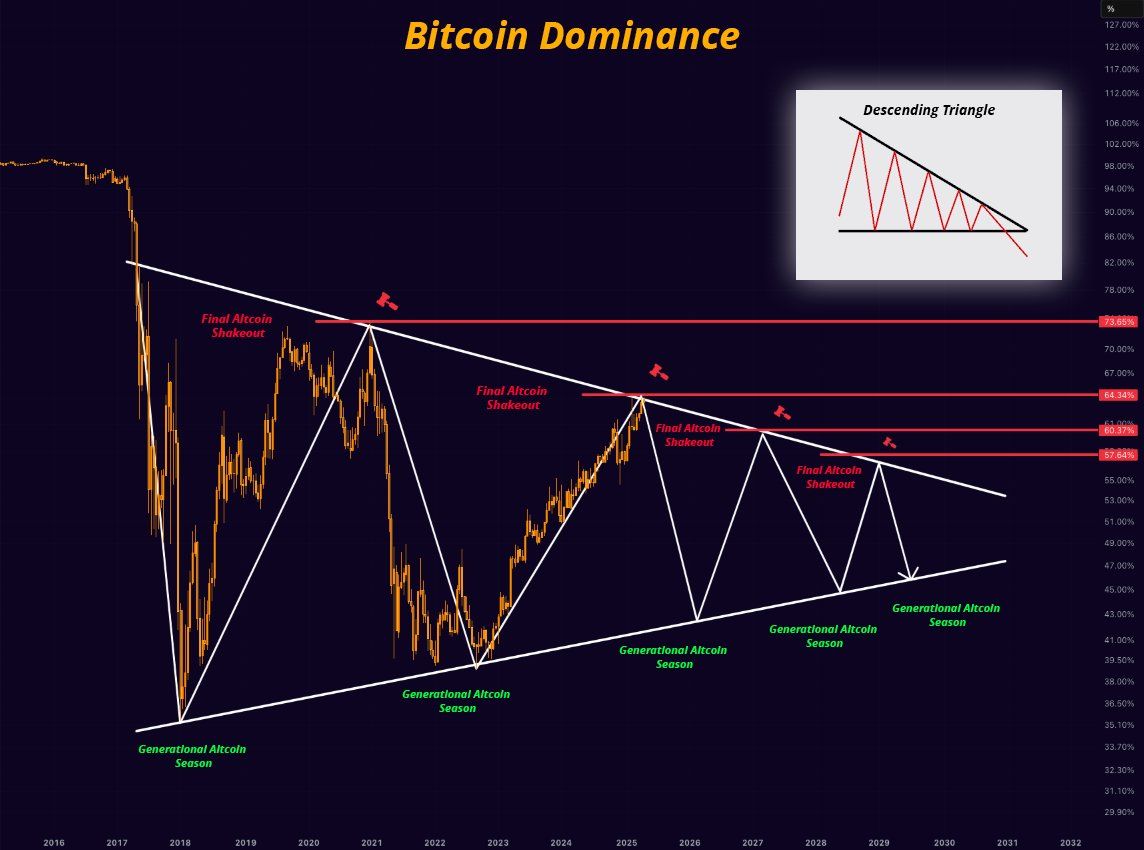

Conversely, analyst Mister Crypto forecasts that Bitcoin’s dominance may pursue a long-term descending triangle pattern. Such a triangle usually indicates bearish momentum, where the price or dominance gradually falls as lower highs are established.

However, this situation could extend its market control until a more extensive correction permits altcoins to gain momentum.

Another analyst highlighted that Bitcoin dominance is currently evaluating the resistance range between 64% and 64.3%. Hence, a potential retracement might be forthcoming. If this retracement occurs, altcoins could start to garner attention, with some possibly rising to become top performers in the market as capital flows away from Bitcoin.

“However, a breakout from this range could signify further declines for alts,” the analyst observed.

Finally, Junaid Dar, the CEO of Bitwardinvest, presented a more hopeful outlook. According to Dar’s assessment, should Bitcoin’s dominance fall below 63.45%, it could instigate a significant upward surge in altcoins. This, he argues, would present a favorable opportunity to capitalize on altcoin positions.

“For the time being, alts are stagnant. It’s just a matter of time,” Dar noted.

Tether Dominance Hints at an Upcoming Altcoin Season

In the meantime, numerous analysts contend that the trends in Tether dominance (USDT.D) point toward a potential altcoin season. From a technical analysis perspective, USDT.D has hit a resistance area and may be due for a correction, implying the likelihood of capital shifting from USDT into altcoins.

“The USDT.D is in a rejection zone; as long as it remains below 6.75%, it will be beneficial for the market,” a technical analyst noted.

Another analyst reiterated that both the USDT.D and USD Coin dominance (USDC.D) have reached a point of resistance, predicting an approaching altcoin season. Doğu Tekinoğlu arrived at similar conclusions by examining the composite chart of BTC.D, USDT.D, and USDC.D.

As Bitcoin’s dominance ascends, investors are keenly observing these technical and on-chain indicators. The relationship between Bitcoin’s strength and stablecoin movements might determine if altcoins can revitalize this summer or continue their consolidation. For now, Bitcoin’s influence in the market remains robust.

Disclaimer

In line with the Trust Project guidelines, BeInCrypto is dedicated to impartial, transparent reporting. This news article aims to provide precise, timely information. However, readers should independently verify facts and consult with a professional prior to making any decisions based on this content. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment